VAT returns for web developers: A complete guide

Do web developers need to file VAT returns?

If you're a freelance web developer in Germany earning above €25,000/year, you must register for VAT and file regular Umsatzsteuervoranmeldungen. This applies whether you build WordPress sites, React apps, or enterprise solutions.

Many developers voluntarily register even below the threshold to reclaim VAT on hardware and software purchases.

What expenses can web developers deduct?

Development work involves significant tool costs, all eligible for Vorsteuer deduction:

Cloud services (AWS, Google Cloud, Azure, Vercel),

Hosting and domains,

Development tools and IDEs (JetBrains, VS Code extensions),

SaaS subscriptions (GitHub, GitLab, Notion, Slack),

Hardware (laptops, monitors, keyboards),

Online courses and certifications,

Co-working space and home office,

Internet and phone.

Every VAT euro on these business expenses can be reclaimed.

Common VAT mistakes developers make

Ignoring international SaaS: Many dev tools are US-based and charge without VAT. But German-hosted services and EU B2B reverse-charge scenarios need correct handling.

Not separating personal subscriptions: That Netflix account isn't deductible. But your Pluralsight subscription for learning new frameworks is.

Missing hardware deductions: That €3,000 MacBook has nearly €500 in reclaimable VAT—if you keep the invoice and register it correctly.

Wrong client invoicing: International clients have different VAT treatments. Charging 19% to a US startup is incorrect.

How Norman helps web developers

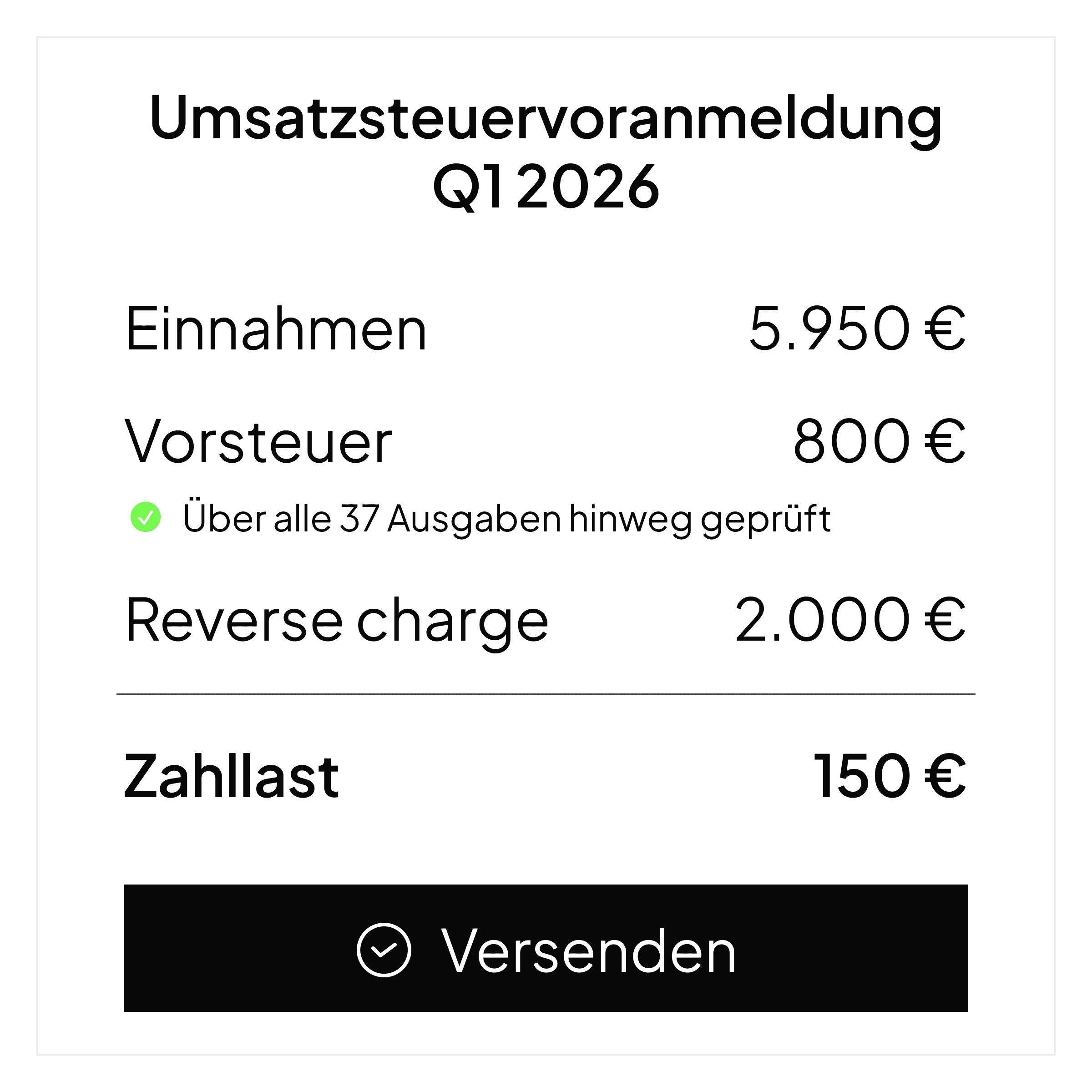

Norman connects to your bank and automatically categorizes tech expenses. It recognizes common vendors like AWS, GitHub, JetBrains, and correctly handles different VAT scenarios. Your UStVA is pre-filled and ready—review in 2 minutes, deploy to the Finanzamt with one click.