VAT returns for graphic designers: A complete guide

Do graphic designers need to file VAT returns?

If you're a freelance graphic designer in Germany earning above the Kleinunternehmer threshold (€25,000/year), you must register for VAT and file regular Umsatzsteuervoranmeldungen. This applies whether you design logos, websites, packaging, or complete brand systems.

Many designers voluntarily opt out of the Kleinunternehmer status even below the threshold—because reclaiming VAT on expensive software and hardware often outweighs the administrative burden.

What expenses can graphic designers deduct?

Design work involves substantial ongoing costs, all eligible for Vorsteuer deduction:

Software subscriptions (Adobe CC, Figma, Sketch, Affinity),

Stock images and fonts,

Computer hardware (displays, tablets, laptops),

Office furniture and ergonomic equipment,

Professional development (courses, conferences),

Client meeting expenses,

Co-working space or studio rent,

Marketing and portfolio hosting.

Every VAT euro on these business expenses can be reclaimed.

Common VAT mistakes graphic designers make

Ignoring small subscriptions: That €10/month font subscription? Over a year, you're missing €19+ in reclaimable VAT.

Not tracking project expenses: Client-specific costs like stock images or specialty fonts purchased for a project are deductible—if you have the invoices.

Mixing personal and business software: Using Creative Cloud for both freelance work and personal projects? Document the business percentage.

Wrong treatment of international clients: EU B2B clients and non-EU clients have different VAT treatments. Applying 19% to everyone is a common and costly mistake.

How Norman helps graphic designers

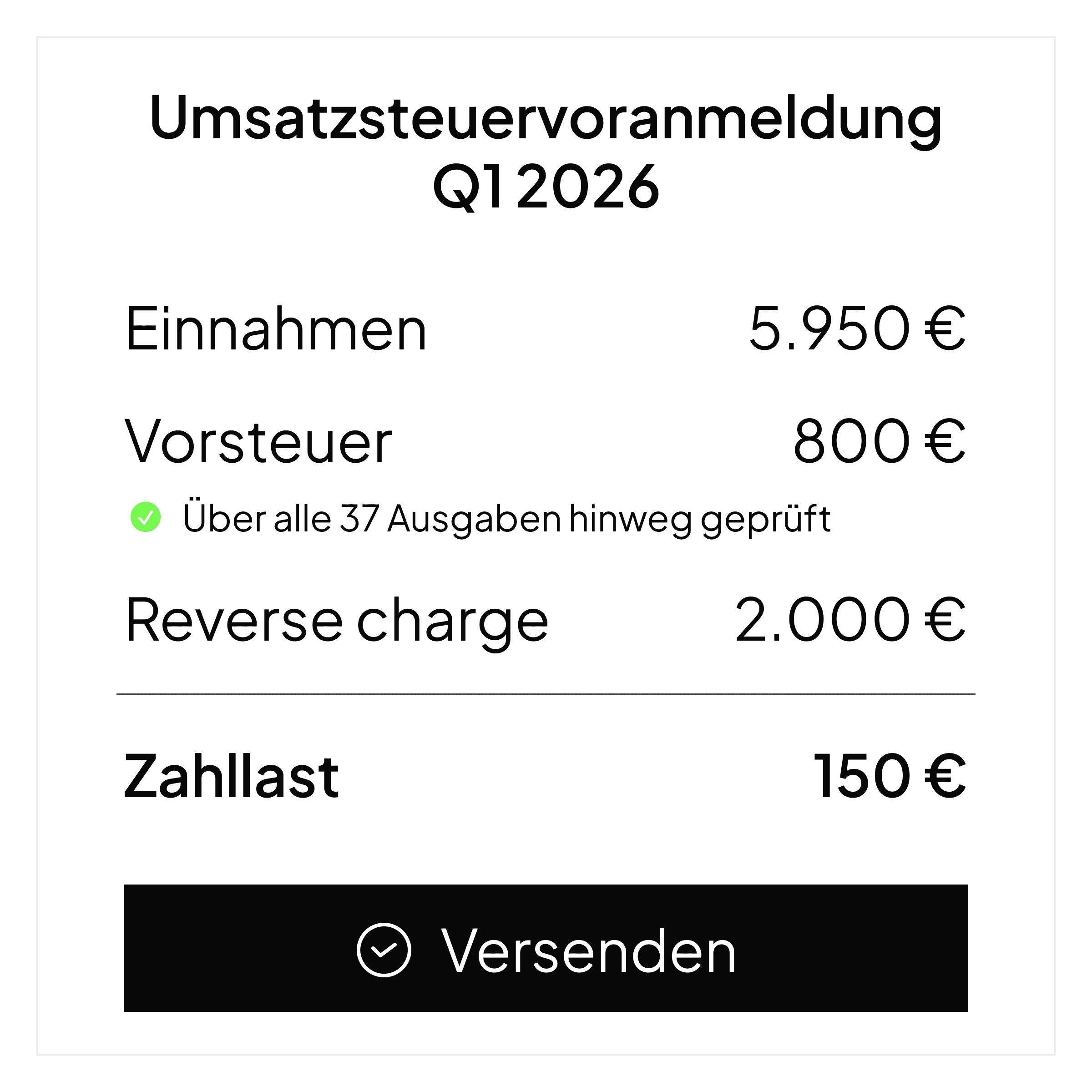

Norman connects to your bank and automatically recognizes design industry expenses—Adobe, Shutterstock, font vendors, and hardware retailers. It tracks your recurring subscriptions and one-time purchases, calculates your VAT position, and pre-fills your UStVA. When filing day arrives, review your numbers in 2 minutes and submit directly to the Finanzamt.