VAT returns for copywriters: A complete guide

Do copywriters need to file VAT returns?

If you're a freelance copywriter in Germany earning above €25,000/year, you must register for VAT and file regular Umsatzsteuervoranmeldungen. This applies whether you write website copy, email campaigns, ads, or content marketing.

What expenses can copywriters deduct?

Copywriting has lower overhead than many professions, but deductible expenses exist:

Writing software (Grammarly, ProWritingAid, Hemingway),

Research tools and databases,

Stock images for portfolio,

Website hosting and domain,

Coworking space,

Books and courses,

Home office expenses.

Every VAT euro on business expenses can be reclaimed.

Common VAT mistakes copywriters make

Missing small subscriptions: That €12/month Grammarly subscription has reclaimable VAT. Track it.

Not claiming home office: If you work from home, you can deduct a portion of your rent, utilities, and internet costs.

Inconsistent invoicing: Make sure your invoices show the correct VAT rate (usually 19% for copywriting services).

Ignoring international clients: Different VAT rules apply for EU and non-EU clients. Getting this wrong means incorrect filings.

How Norman helps copywriters

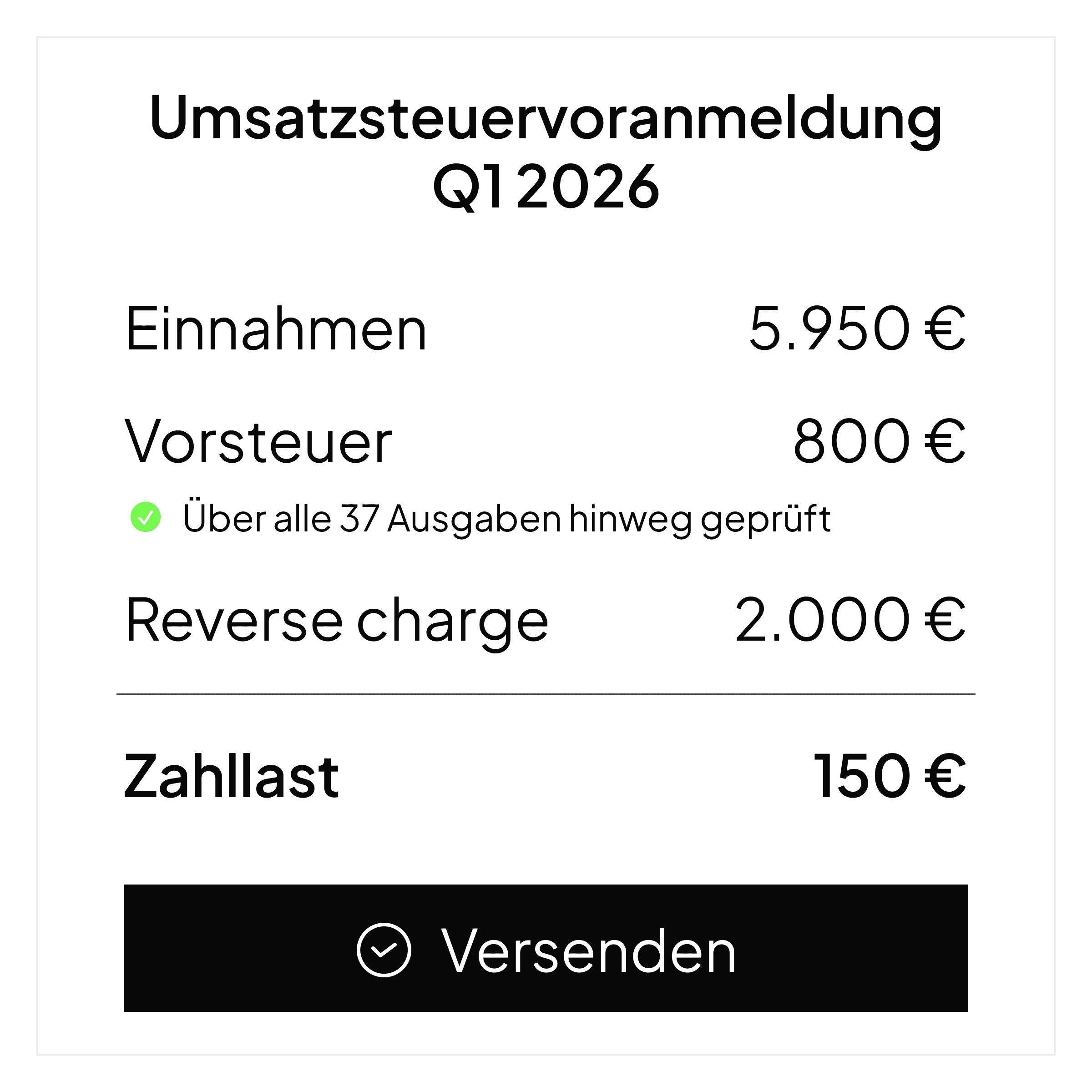

Norman connects to your bank and automatically categorizes your income and expenses. It tracks payments from multiple clients, catches your recurring subscriptions, and pre-fills your UStVA. Review in 2 minutes, submit with one click.