VAT returns for photographers: Everything you need to know

Do photographers need to file VAT returns?

If you're a freelance photographer in Germany earning above the Kleinunternehmer threshold (€25,000/year), you must register for VAT and file regular Umsatzsteuervoranmeldungen. This applies whether you shoot weddings, corporate events, portraits, or commercial work.

Even if you're below the threshold, many photographers voluntarily register for VAT to reclaim input VAT on expensive equipment purchases.

What expenses can photographers deduct?

Photography involves significant equipment investments, all of which qualify for Vorsteuer deduction:

Camera bodies and lenses,

Lighting equipment and modifiers,

Tripods, bags, and accessories,

Editing software (Lightroom, Capture One, Photoshop),

Computer hardware and storage,

Studio rent and utilities,

Travel expenses for shoots,

Props and backdrops,

Insurance and professional memberships.

Every euro of VAT you paid on these business expenses reduces your VAT liability.

Common VAT mistakes photographers make

Mixing personal and business gear: That camera you also use for family photos? You can only deduct the business-use portion. Keep clear records.

Forgetting software subscriptions: Monthly Adobe payments add up. Each one includes deductible VAT.

Missing travel deductions: Mileage to shoots, hotel stays for destination weddings, flights for commercial projects—all deductible if properly documented.

Wrong VAT rate on invoices: Most photography services are taxed at 19%. But certain educational photography workshops might qualify for reduced rates. Know your rates.

How Norman helps photographers

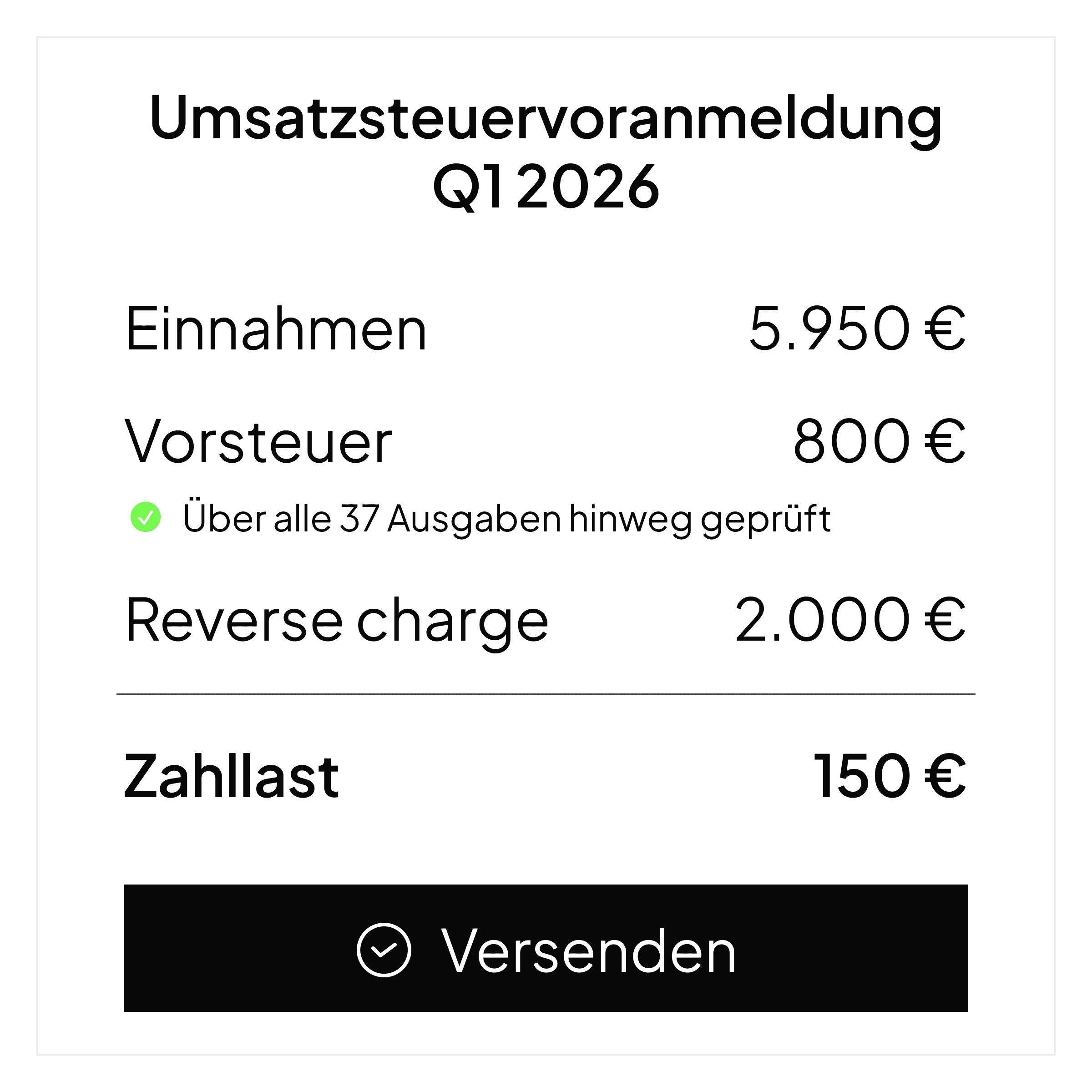

Norman connects to your bank account and automatically categorizes photography-specific expenses. It recognizes common vendors like Adobe, B&H, camera retailers, and flags them appropriately. When filing day comes, your UStVA is pre-filled with accurate numbers. Review in 2 minutes, submit with one click.

No more spreadsheets. No more guessing which field in Elster needs which number. No more €80/month to a tax advisor for basic arithmetic.