Filing your VAT return without Elster: Everything you need to know

Do you have to use Elster for your UStVA?

No. German tax law requires electronic submission of VAT returns, but it doesn't require you to use the Elster web portal. The Finanzamt accepts submissions from any software that connects through the Elster integration—the same backend that powers Elster itself.

Norman is listed among official Elster software providers: https://www.elster.de/elsterweb/softwareprodukt.

This means you can file your Umsatzsteuervoranmeldung through accounting software like Norman without ever logging into Elster, setting up certificates, or navigating the portal's complex forms.

Why do people avoid Elster?

The complaints are consistent:

The certificate system is confusing. You need to create an account, request a certificate, download it, store it securely, and remember to renew it. Lose the certificate? Start over.

The interface is overwhelming. The UStVA form has dozens of fields, most of which don't apply to typical freelancers. Finding the three fields you actually need takes longer than calculating the numbers.

Error messages are cryptic. Something went wrong? Good luck figuring out what. Elster's error codes often require a Google search to decode.

No mobile access. Need to file while traveling? The Elster portal barely works on desktop, let alone on a phone.

What are the alternatives to Elster?

Any tax software Elster integration can replace the Elster portal for VAT returns:

Option | Pros | Cons |

|---|---|---|

Norman | Automated VAT calculation, bank sync, one-click submission | Some cases in personal income tax declaration are missing (like real estate |

WISO Steuer | Comprehensive tax coverage | Desktop-focused, complex interface |

Lexoffice | Old-school accounting platform | Higher price point, complex interface |

Tax advisor | Handles everything | Expensive, starts at 2.500 € a year. |

Norman is specifically designed for freelancers and self-employed individuals who want the simplest path from bank transaction to submitted UStVA.

Is submitting without Elster legal?

Completely legal. The legal requirement is electronic transmission to the Finanzamt—not use of a specific portal. ERiC-certified software meets all legal requirements. The Finanzamt receives your data in exactly the same format and with the same legal validity as an Elster submission.

You'll receive an official transmission confirmation (Übertragungsprotokoll) as proof of submission, just like you would through Elster.

What do you need to file without Elster?

To submit your UStVA through Norman instead of Elster:

Your tax number (Steuernummer): Assigned by your local Finanzamt when you registered your business

Your bank transactions: Connected via bank sync or manually entered

Your invoices and receipts: For accurate VAT calculation and input VAT deduction

You don't need an Elster account, an Elster certificate, or any Elster login credentials. Norman handles authentication with the tax authorities directly.

How long does submission take?

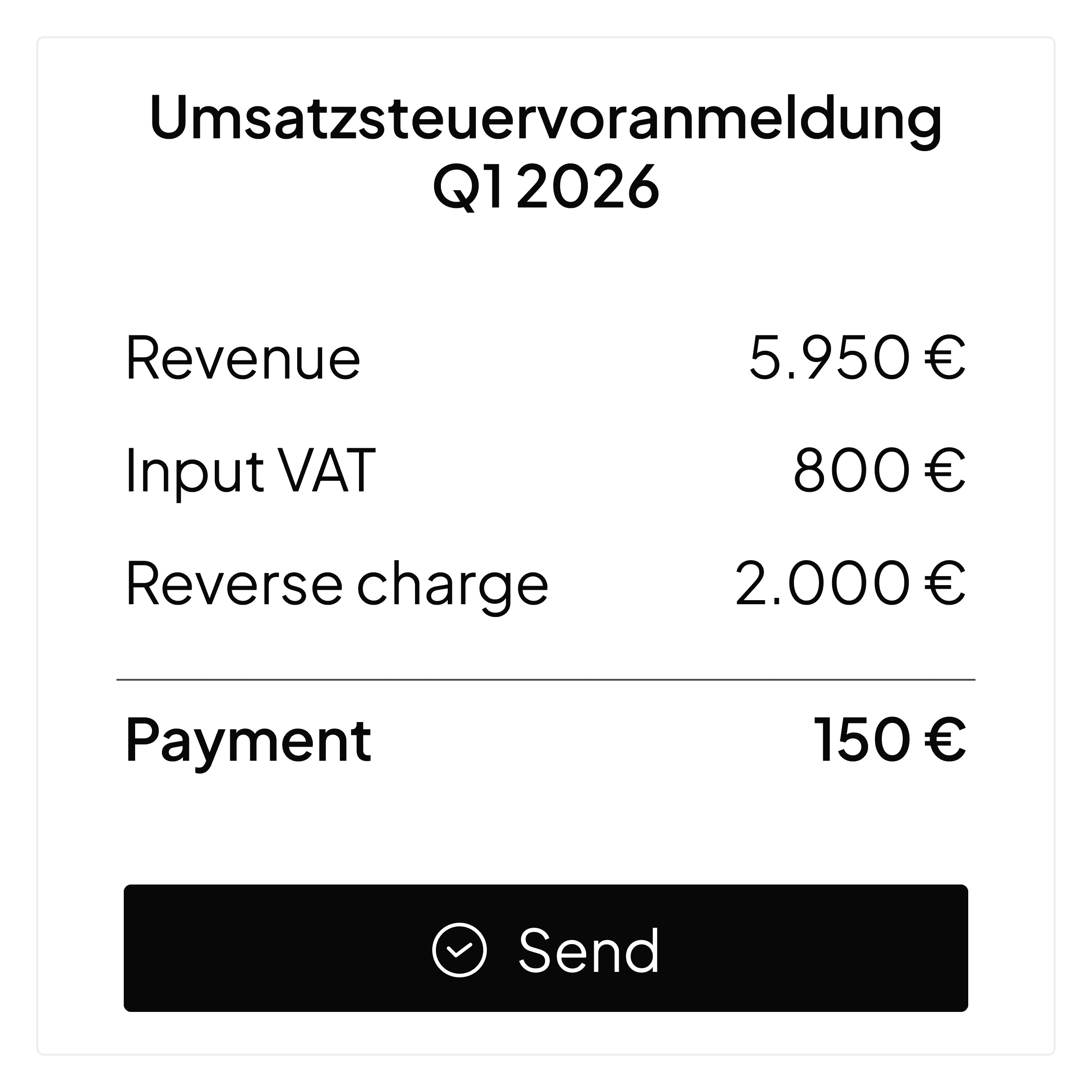

Through Elster: Plan for 30-60 minutes if you know what you're doing. Longer if you're searching for the right form fields or troubleshooting errors.

Through Norman: Under 2 minutes. Your VAT is calculated automatically from your transactions. Review the pre-filled return, click submit, done. Confirmation arrives within seconds.