Do your own VAT return — without Elster, without a tax advisor.

Do your own VAT return — without Elster, without a tax advisor.

Enter income and expenses.

VAT is calculated automatically.

Submit without Elster and a Steuerberater.

Enter income and expenses.

VAT is calculated automatically.

Submit without Elster and a Steuerberater.

Join over 3,000 self-employed already using Norman.

Join over 3,000 self-employed already using Norman.

How it works

Sync your bank

Income and expenses are categorized and auto-matched with invoices.

Sync your bank

Income and expenses are categorized and auto-matched with invoices.

Sync your bank

Income and expenses are categorized and auto-matched with invoices.

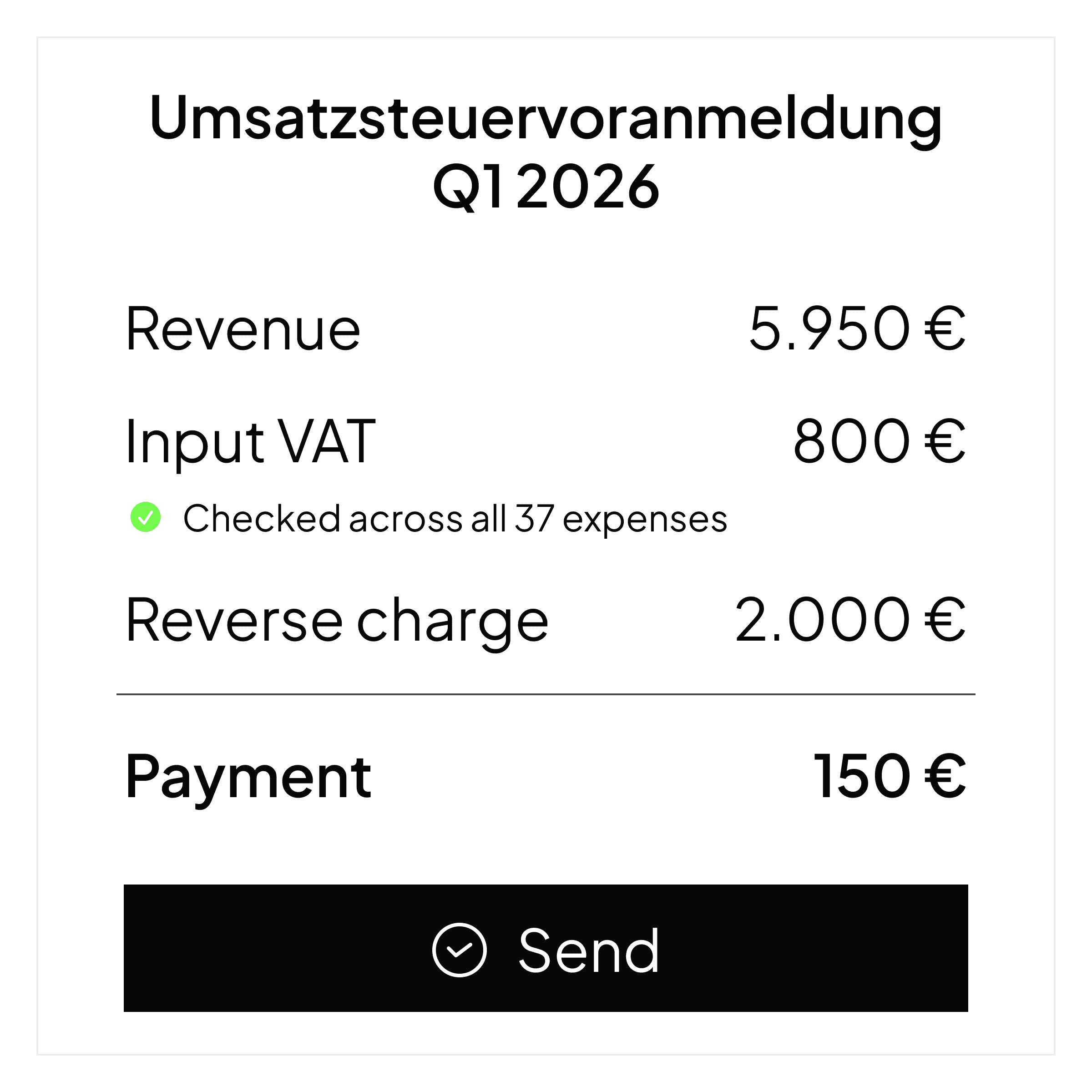

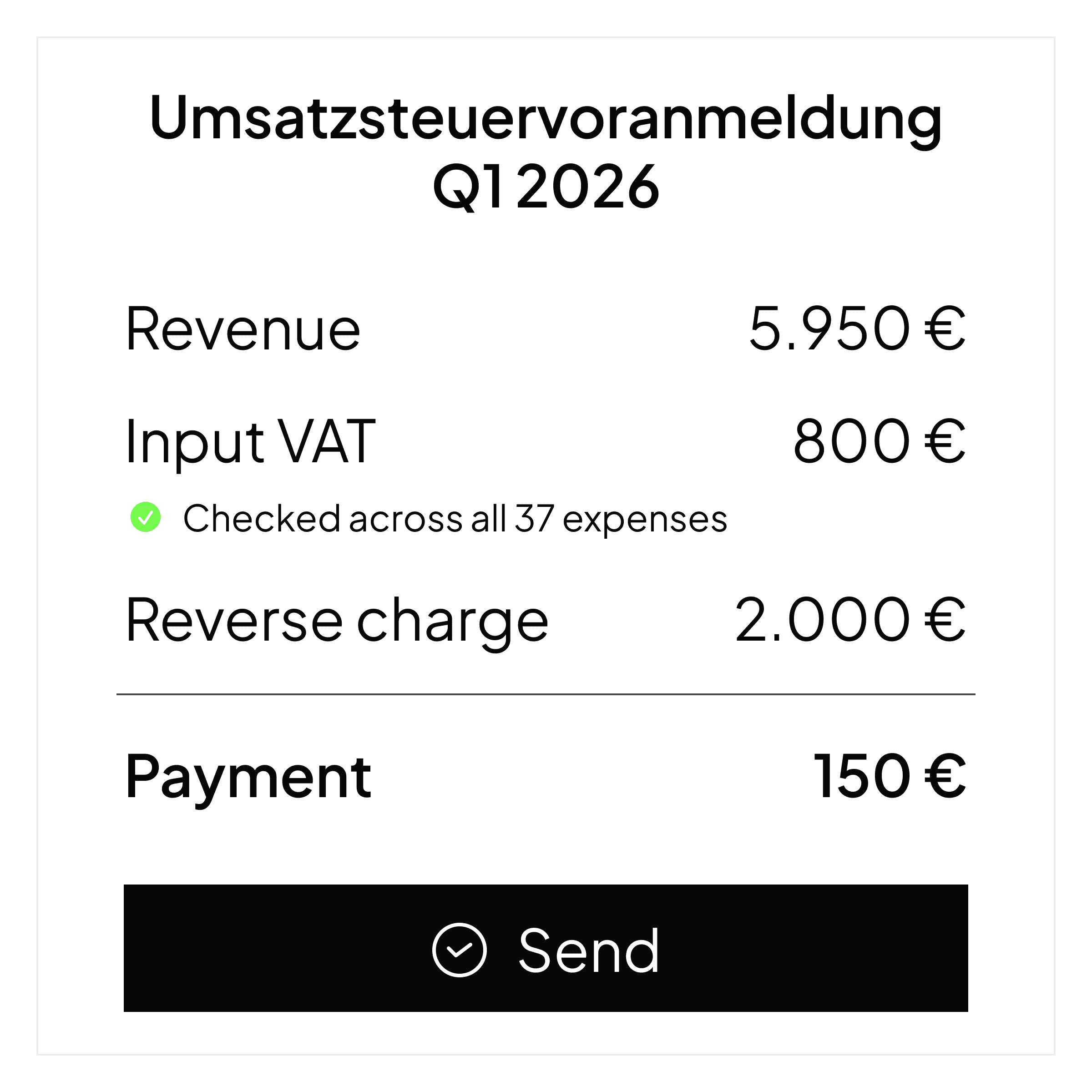

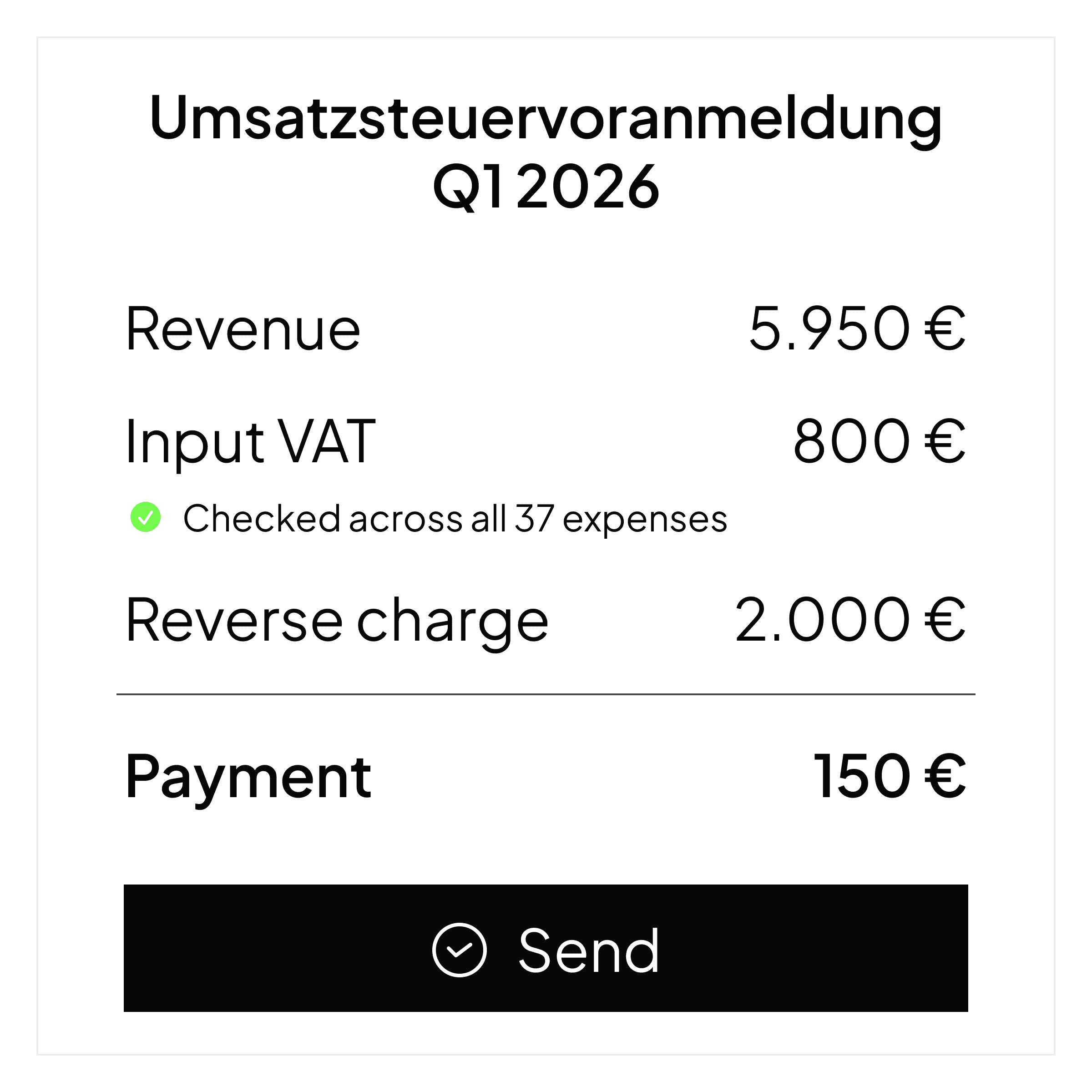

UStVA already pre-filled

Revenue, input VAT, and Reverse Charge are filled out. Review is easy with tips.

UStVA already pre-filled

Revenue, input VAT, and Reverse Charge are filled out. Review is easy with tips.

UStVA already pre-filled

Revenue, input VAT, and Reverse Charge are filled out. Review is easy with tips.

Submit to the Finanzamt

Send your UStVA directly from Norman. No Elster login, no manual forms.

Submit to the Finanzamt

Send your UStVA directly from Norman. No Elster login, no manual forms.

Submit to the Finanzamt

Send your UStVA directly from Norman. No Elster login, no manual forms.

Built in Germany for

Designers

Developers

Etsy sellers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Etsy sellers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Etsy sellers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Hear from fellow freelancers

Tax filing for modern self-employed

Tax filing for modern self-employed

Tax filing for modern self-employed

From entry to ELSTER submission: Norman guides you through your VAT return step by step – no prior tax knowledge, no stress.

Input VAT automatically recognized

Norman detects deductible VAT and applies it correctly.

Input VAT automatically recognized

Norman detects deductible VAT and applies it correctly.

Input VAT automatically recognized

Norman detects deductible VAT and applies it correctly.

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

No manual work

Receipts and expenses are automatically matched to the right transactions.

No manual work

Receipts and expenses are automatically matched to the right transactions.

No manual work

Receipts and expenses are automatically matched to the right transactions.

ELSTER submission included

File directly with the tax office – no Elster forms or paperwork.

ELSTER submission included

File directly with the tax office – no Elster forms or paperwork.

ELSTER submission included

File directly with the tax office – no Elster forms or paperwork.

Live tax estimates

Know the next deadline and see your tax burden change in real-time.

Live tax estimates

Know the next deadline and see your tax burden change in real-time.

Live tax estimates

Know the next deadline and see your tax burden change in real-time.

AI advisor

AI advisor

Bank sync

Bank sync

Voice invoicing

Voice invoicing

Start for free

Start for free

Wow support

Wow support

Make accounting effortless

Make accounting effortless

Save time with AI Autopilot. Stop wasting hours on taxes, invoices, and gathering receipts.

Save time with AI Autopilot. Stop wasting hours on taxes, invoices, and gathering receipts.

Save time with AI Autopilot. Stop wasting hours on taxes, invoices, and gathering receipts.

3 150 €

3 150 €

3 150 €

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

8 hours

8 hours

8 hours

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Stress

Stress

Stress

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

At Norman, the essentials are free.

Also, it's tax-deductible.

Billed yearly

(3 months free)

Free

Core accounting for free.

€0

Self-employment registration

Unlimited e-invoicing

Tax write-off tips

Bank sync

AI Autopilot

Get started

Klein

For Kleinunternehmer.

€12

/month (excl. VAT)

- 25%

Annual tax declarations (EÜR)

Personal income tax

Declare salary as an employee

EU revenue reports (ZM)

Invoicing pro plan

Get started

Pro

For self-employed charging VAT.

€24

/month (excl. VAT)

- 25%

VAT returns

All tax declarations

Tax efficiency score

Receipt auto-matching

Invoicing pro plan

Get started

Billed yearly

(3 months free)

Free

Core accounting for free.

€0

Self-employment registration

Unlimited e-invoicing

Tax write-off tips

Bank sync

AI Autopilot

Get started

Klein

For Kleinunternehmer.

€12

/month (excl. VAT)

- 25%

Annual tax declarations (EÜR)

Personal income tax

Declare salary as an employee

EU revenue reports (ZM)

Invoicing pro plan

Get started

Pro

For self-employed charging VAT.

€24

/month (excl. VAT)

- 25%

VAT returns

All tax declarations

Tax efficiency score

Receipt auto-matching

Invoicing pro plan

Get started

Billed yearly

(3 months free)

Free

Core accounting for free.

€0

Self-employment registration

Unlimited e-invoicing

Tax write-off tips

Bank sync

AI Autopilot

Get started

Klein

For Kleinunternehmer.

€12

/month (excl. VAT)

- 25%

Annual tax declarations (EÜR)

Personal income tax

Declare salary as an employee

EU revenue reports (ZM)

Invoicing pro plan

Get started

Pro

For self-employed charging VAT.

€24

/month (excl. VAT)

- 25%

VAT returns

All tax declarations

Tax efficiency score

Receipt auto-matching

Invoicing pro plan

Get started