Calvin special

First 3 months free

First 3 months free

First 3 months free

Freelance taxes,

Simplified.

Freelance taxes,

Simplified.

Freelance taxes,

Simplified.

Save 8h/month with the tax autopilot.

No more stress with the Finanzamt.

Free tax registration, invoicing, and much more.

Save 8h/month with the tax autopilot.

No more stress with the Finanzamt.

Free tax registration, invoicing, and much more.

Save 8h/month with the tax autopilot.

No more stress with the Finanzamt.

Free tax registration, invoicing, and much more.

Built in Germany for

Built in Germany for

Built in Germany for

Designers

Developers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Hear from fellow freelancers

Hear from fellow freelancers

Hear from fellow freelancers

Complete accounting. Automated.

Complete accounting. Automated.

Complete accounting. Automated.

Stop spending hours on accounting, invoice collection, and taxes.

Stop spending hours on accounting, invoice collection, and taxes.

Stop spending hours on accounting, invoice collection, and taxes.

Maximize tax deductions.

Maximize tax deductions.

Maximize tax deductions.

Norman auto-finds deductibles and provides personalized tips for missed expenses.

Norman auto-finds deductibles and provides personalized tips for missed expenses.

Norman auto-finds deductibles and provides personalized tips for missed expenses.

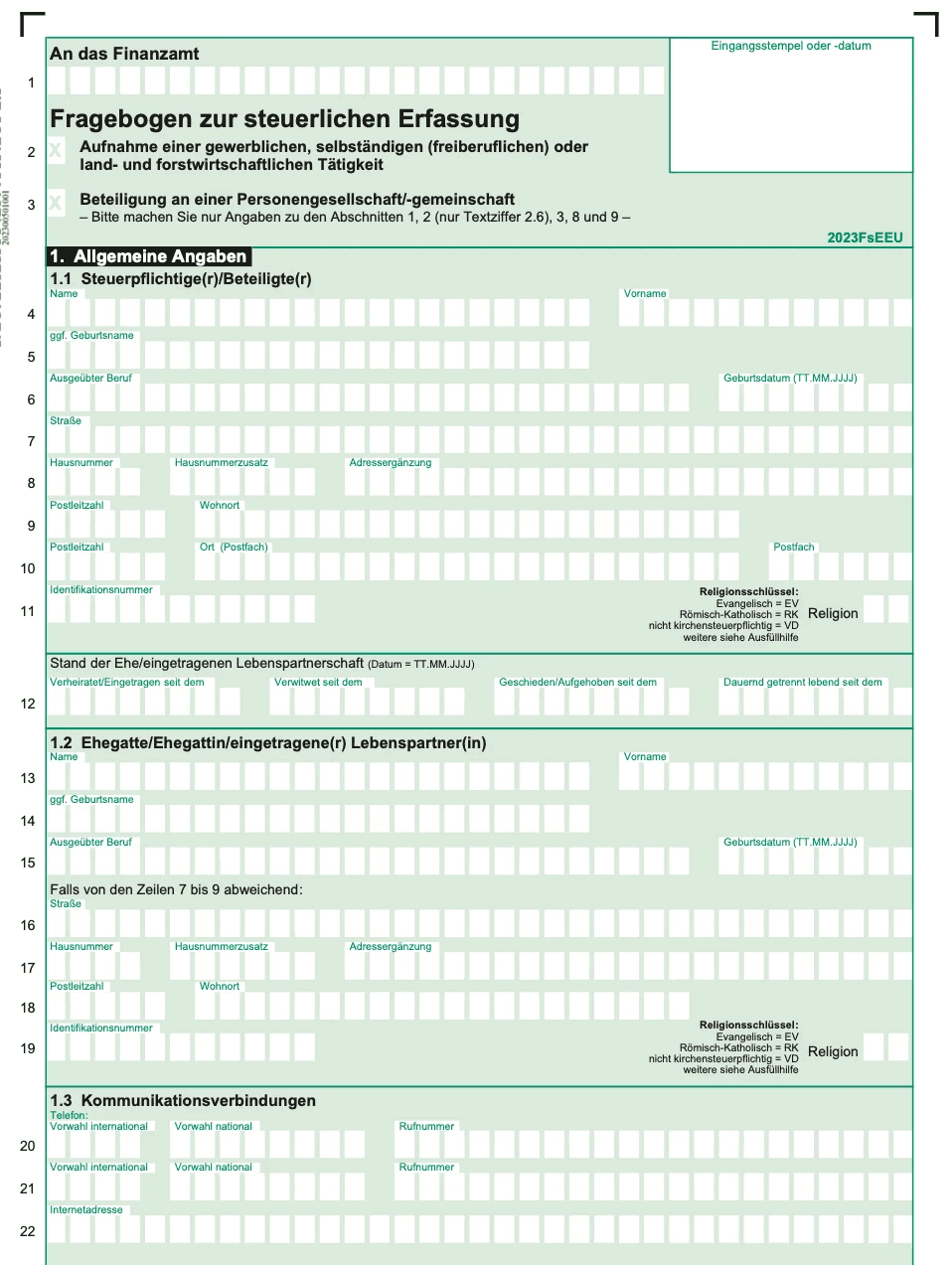

Easily generate all your tax declarations.

Easily generate all your tax declarations.

Easily generate all your tax declarations.

All declarations are already filled out. Check the draft and submit your tax return directly to the local tax office.

All declarations are already filled out. Check the draft and submit your tax return directly to the local tax office.

All declarations are already filled out. Check the draft and submit your tax return directly to the local tax office.

Automatic document recognition.

Automatic document recognition.

Automatic document recognition.

No more receipt chaos. Norman automatically matches transactions with the uploaded receipts.

No more receipt chaos. Norman automatically matches transactions with the uploaded receipts.

No more receipt chaos. Norman automatically matches transactions with the uploaded receipts.

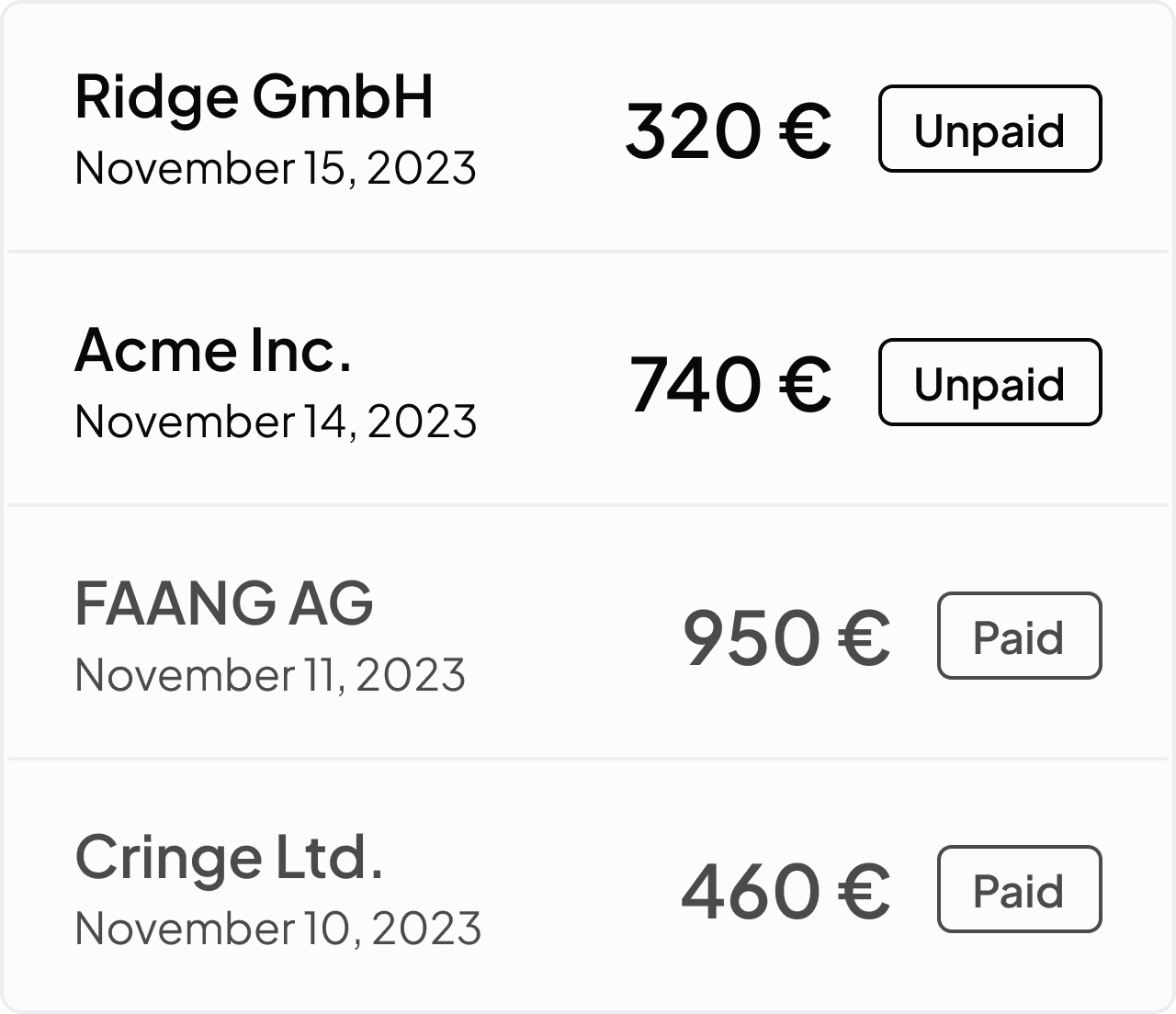

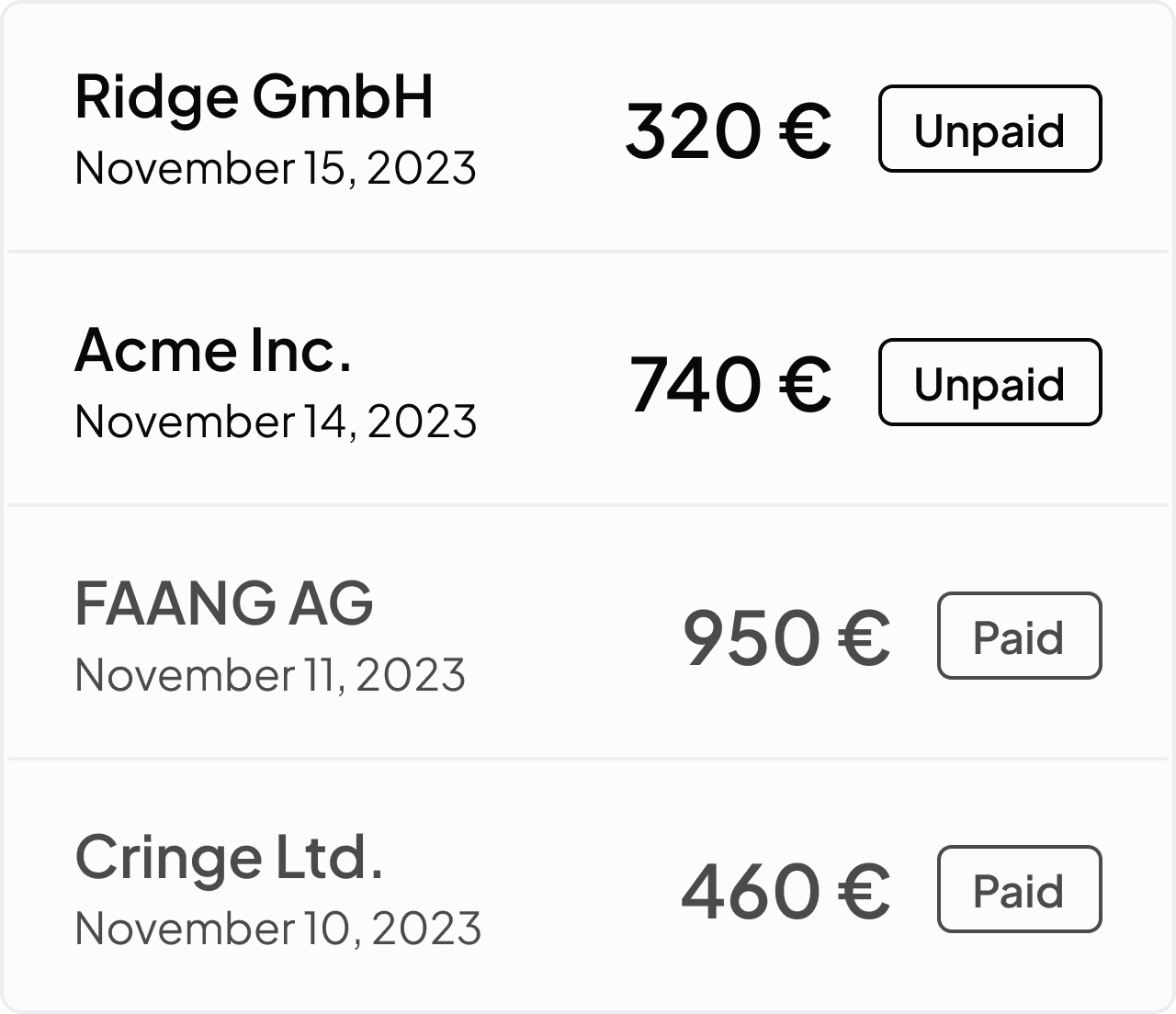

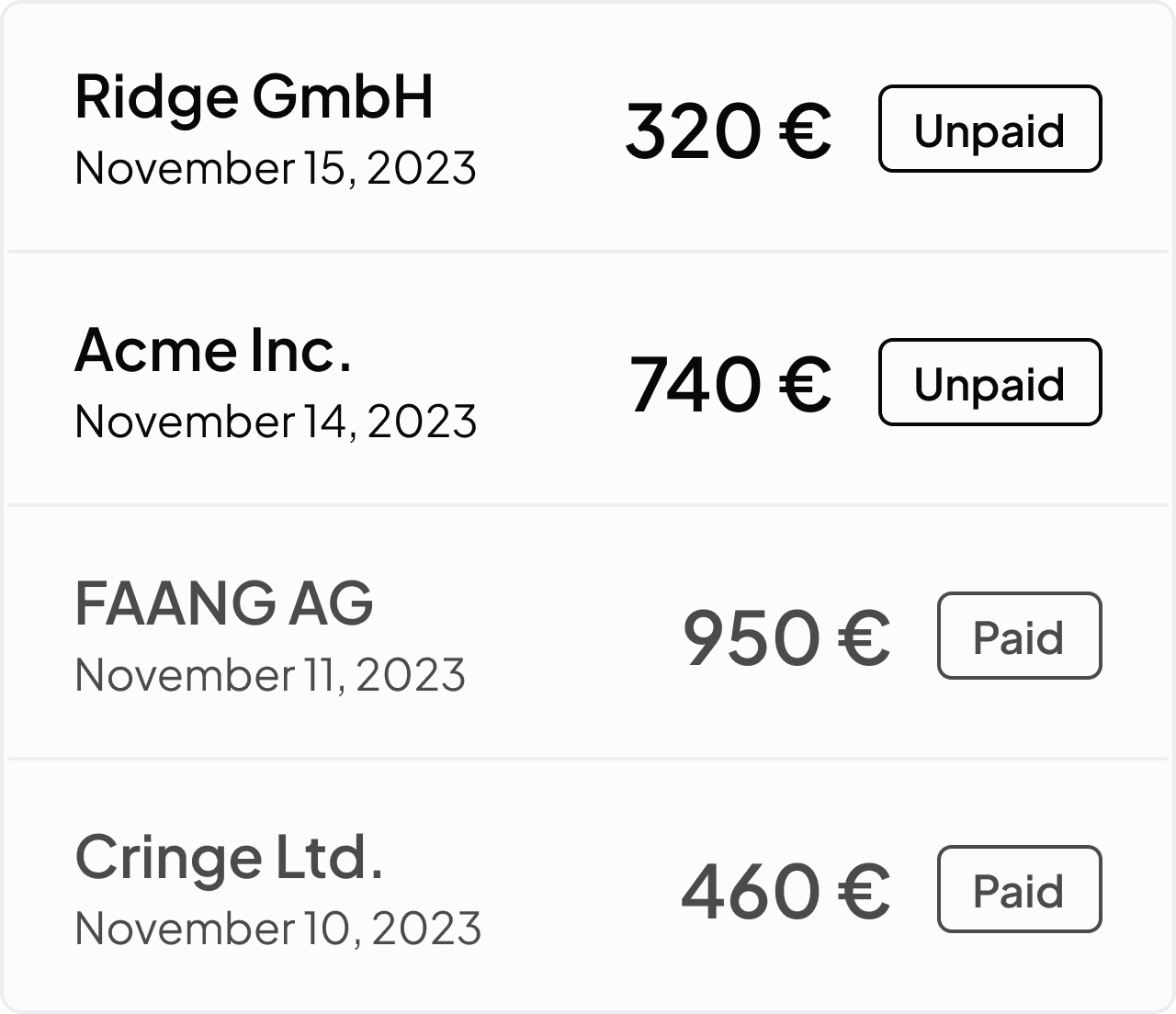

Easy invoicing.

Easy invoicing.

Easy invoicing.

Norman seamlessly creates compliant invoices based on your and your client's details.

Norman seamlessly creates compliant invoices based on your and your client's details.

Norman seamlessly creates compliant invoices based on your and your client's details.

Pay less for accounting.

Pay less for accounting.

Pay less for accounting.

Save time thanks to the Norman AI co-pilot. Stop spending hours on taxes, invoices, and collecting receipts.

Save time thanks to the Norman AI co-pilot. Stop spending hours on taxes, invoices, and collecting receipts.

Get finance superpowers with Norman AI co-pilot. Stop spending hours on taxes, invoices, and receipt collection.

3 150 €

3 150 €

3 150 €

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

8 hours

8 hours

8 hours

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Stress

Stress

Stress

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

At Norman, the essentials are free.

At Norman, the essentials are free.

At Norman, the essentials are free.

Free

Ideal for individuals who need quick access to basic features

0

€

/month

(excl. VAT)

Zero manual entries (bank sync)

Smart invoicing

Deductibles tips and guidance

Receipt management

Get Started

Free

Ideal for individuals who need quick access to basic features

0

€

/month

(excl. VAT)

Zero manual entries (bank sync)

Smart invoicing

Deductibles tips and guidance

Receipt management

Get Started

Free

Ideal for individuals who need quick access to basic features

0

€

/month

(excl. VAT)

Zero manual entries (bank sync)

Smart invoicing

Deductibles tips and guidance

Receipt management

Get Started

Small

Yearly (3 months free)

For Kleinunternehmer with less than €22.000 revenue per year.

7

€

/month

(excl. VAT)

Profit and loss statement (EÜR)

Smart invoicing

Personal income tax return

Receipt auto-matching

Get Started

Small

Yearly (3 months free)

For Kleinunternehmer with less than €22.000 revenue per year.

7

€

/month

(excl. VAT)

Profit and loss statement (EÜR)

Smart invoicing

Personal income tax return

Receipt auto-matching

Get Started

Small

Yearly (3 months free)

For Kleinunternehmer with less than €22.000 revenue per year.

7

€

/month

(excl. VAT)

Profit and loss statement (EÜR)

Smart invoicing

Personal income tax return

Receipt auto-matching

Get Started

Business

Yearly (3 months free)

For Gewerbetreibende and Freelancers that charge VAT

22

€

/month

(excl. VAT)

VAT reports

EÜR and annual filings

Receipt auto-matching

Norman AI co-pilot

Get Started

Business

Yearly (3 months free)

For Gewerbetreibende and Freelancers that charge VAT

22

€

/month

(excl. VAT)

VAT reports

EÜR and annual filings

Receipt auto-matching

Norman AI co-pilot

Get Started

Business

Yearly (3 months free)

For Gewerbetreibende and Freelancers that charge VAT

22

€

/month

(excl. VAT)

VAT reports

EÜR and annual filings

Receipt auto-matching

Norman AI co-pilot

Get Started

Learn more about taxes and finance in our blog.

Learn more about taxes and finance in our blog.

Learn more about taxes and finance in our blog.

FAQ

FAQ

FAQ

What exactly is Norman?

Norman is the Accounting Autopilot for modern entrepreneurs. It helps minimize audit risk and save money. Our mission is to make your everyday business life as easy as possible.

I am not self-employed. Can I file my income tax through Norman?

Yes! Norman supports salary from employment, donations, joint filings, etc. Still, we don't cover 100% of cases (e.g., solar installation subsidies).

Can I really do it myself?

Yes! If you use Norman, you usually don't need a tax advisor or accountant. Our mission is to make tax filing more accessible, faster, and less stressful. Thousands of individuals, self-employed, and businesses file their taxes without a Steuerberater. Many even do it on Elster, where it can be challenging to understand the questions and whether they are relevant to you. Norman endorses the official Elster portal.

How much does Norman cost?

The income tax submission for individuals costs €29. The self-employment registration form, smart invoicing, and bookkeeping are free. The monthly plans for self-employed start at €11/€22 for Kleinunternehmen/VAT payers.

Does Norman support Gewerbetreibende:r or is it for freelancers only?

Yes! We equally support Kleinunternehmer, Freiberufler:in, and Gewerbetreibende:r. You can submit the Gewerbesteuererklärung (Trade tax declaration) with Norman.

Can I trust my data with Norman?

Yes! Norman adheres to German data privacy requirements and stores your data only in data centers located in Frankfurt. When you connect a bank account, Norman NEVER sees the credentials used. Bank connection is provided by a PSD2 licensed Open Banking provider.

Does AI make a difference?

Yes! Modern AI models are extremely good at categorization and extracting information from documents (like VAT from a receipt). We assembled a collection of best-in-class models to save you hours on bookkeeping and tax filing. We've tuned the top-notch language model to work specifically with German tax law. Still, Norman can make mistakes. Check important information.

What exactly is Norman?

Norman is the Accounting Autopilot for modern entrepreneurs. It helps minimize audit risk and save money. Our mission is to make your everyday business life as easy as possible.

I am not self-employed. Can I file my income tax through Norman?

Yes! Norman supports salary from employment, donations, joint filings, etc. Still, we don't cover 100% of cases (e.g., solar installation subsidies).

Can I really do it myself?

Yes! If you use Norman, you usually don't need a tax advisor or accountant. Our mission is to make tax filing more accessible, faster, and less stressful. Thousands of individuals, self-employed, and businesses file their taxes without a Steuerberater. Many even do it on Elster, where it can be challenging to understand the questions and whether they are relevant to you. Norman endorses the official Elster portal.

How much does Norman cost?

The income tax submission for individuals costs €29. The self-employment registration form, smart invoicing, and bookkeeping are free. The monthly plans for self-employed start at €11/€22 for Kleinunternehmen/VAT payers.

Does Norman support Gewerbetreibende:r or is it for freelancers only?

Yes! We equally support Kleinunternehmer, Freiberufler:in, and Gewerbetreibende:r. You can submit the Gewerbesteuererklärung (Trade tax declaration) with Norman.

Can I trust my data with Norman?

Yes! Norman adheres to German data privacy requirements and stores your data only in data centers located in Frankfurt. When you connect a bank account, Norman NEVER sees the credentials used. Bank connection is provided by a PSD2 licensed Open Banking provider.

Does AI make a difference?

Yes! Modern AI models are extremely good at categorization and extracting information from documents (like VAT from a receipt). We assembled a collection of best-in-class models to save you hours on bookkeeping and tax filing. We've tuned the top-notch language model to work specifically with German tax law. Still, Norman can make mistakes. Check important information.

What exactly is Norman?

Norman is the Accounting Autopilot for modern entrepreneurs. It helps minimize audit risk and save money. Our mission is to make your everyday business life as easy as possible.

I am not self-employed. Can I file my income tax through Norman?

Yes! Norman supports salary from employment, donations, joint filings, etc. Still, we don't cover 100% of cases (e.g., solar installation subsidies).

Can I really do it myself?

Yes! If you use Norman, you usually don't need a tax advisor or accountant. Our mission is to make tax filing more accessible, faster, and less stressful. Thousands of individuals, self-employed, and businesses file their taxes without a Steuerberater. Many even do it on Elster, where it can be challenging to understand the questions and whether they are relevant to you. Norman endorses the official Elster portal.

How much does Norman cost?

The income tax submission for individuals costs €29. The self-employment registration form, smart invoicing, and bookkeeping are free. The monthly plans for self-employed start at €11/€22 for Kleinunternehmen/VAT payers.

Does Norman support Gewerbetreibende:r or is it for freelancers only?

Yes! We equally support Kleinunternehmer, Freiberufler:in, and Gewerbetreibende:r. You can submit the Gewerbesteuererklärung (Trade tax declaration) with Norman.

Can I trust my data with Norman?

Yes! Norman adheres to German data privacy requirements and stores your data only in data centers located in Frankfurt. When you connect a bank account, Norman NEVER sees the credentials used. Bank connection is provided by a PSD2 licensed Open Banking provider.

Does AI make a difference?

Yes! Modern AI models are extremely good at categorization and extracting information from documents (like VAT from a receipt). We assembled a collection of best-in-class models to save you hours on bookkeeping and tax filing. We've tuned the top-notch language model to work specifically with German tax law. Still, Norman can make mistakes. Check important information.

© 2024 Norman AI GmbH

© 2024 Norman AI GmbH

© 2024 Norman AI GmbH