Self-employment registration: When is a freelancer, when is a Gewerbe?

Diana

Updated on:

Oct 30, 2025

Starting self-employment in Germany can be an exciting yet challenging journey. Whether you're planning to work as a freelancer (Freiberufler) or run a commercial business (Gewerbetreibender), understanding the registration process and legal requirements is essential. This guide will walk you through the key steps, considerations, and tips for successfully registering and managing your self-employed business in Germany.

🫶 Figuring out your professional classification in Germany is key because it shapes how you register and the taxes and responsibilities that come with being a freelancer or business owner. But don’t worry, it’s not the big scary monster it might seem at first! It’s actually way simpler once you dive in.

Freiberufler vs. Gewerbetreibender: Understanding the Difference

First, let's start with the basics. Who are Freiberufler and Gewerbetreibender?

Who is a Freiberufler?

In the German legal and tax system, a Freiberufler (freelancer) refers to individuals engaged in certain self-employed, "intellectual" or creative professions. Freiberufler:in focus on providing knowledge-based services rather than selling goods.

Certain professions are legally recognized as freelance work (freie Berufe) in Germany. These typically involve specialized knowledge, skills, or creative talents:

Healthcare Professionals: Doctors, dentists, psychotherapists, veterinarians

Legal and Economic Advisors: Lawyers, tax advisors, auditors, consultants

Scientific and Technical Professions: Engineers, architects, chemists

Information and Communication: Journalists, interpreters, translators

Creative and Artistic Professions: Writers, musicians, artists, designers

Education and Teaching: Private tutors, educators

🙃 Sure, there are plenty of exceptions. For example, take software developers—they can fall into either category depending on their work. If they focus on consulting or developing highly specialized software for clients, they’re typically considered freelancers. But if they’re selling or distributing software or games, they’re more likely to be classified as tradespeople.

Who is a Gewerbetreibender?

A Gewerbetreibender (tradesperson) covers a broad spectrum of commercial activities, from running a retail store to offering repair services or any other type of for-profit business that doesn’t fit into the Freiberufler category.

Freiberufler (freelancers) typically work in specialized intellectual or creative fields, whereas Gewerbetreibende (tradespeople or commercial business owners) cover a much wider range of activities. In general, any self-employed work that doesn’t fit into the Freiberufler category is classified as Gewerbe. Here are a few common examples:

Retail and E-commerce: Shop owners, online sellers, market traders

Hospitality and Food Service: Restaurant owners, caterers, food truck operators

Skilled Trades: Carpenters, electricians, plumbers, mechanics

Personal Services: Hairdressers, beauticians, massage therapists

Manufacturing: Small-scale producers, craftspeople

Real Estate: Property developers, real estate agents

Transportation and Logistics: Taxi drivers, courier services

Travel and Tourism: Tour operators, travel agents

Entertainment and Events: DJs, event planners

Digital Services: Web designers, SEO specialists (when not considered Freiberufler)

How to register as a Freiberufler

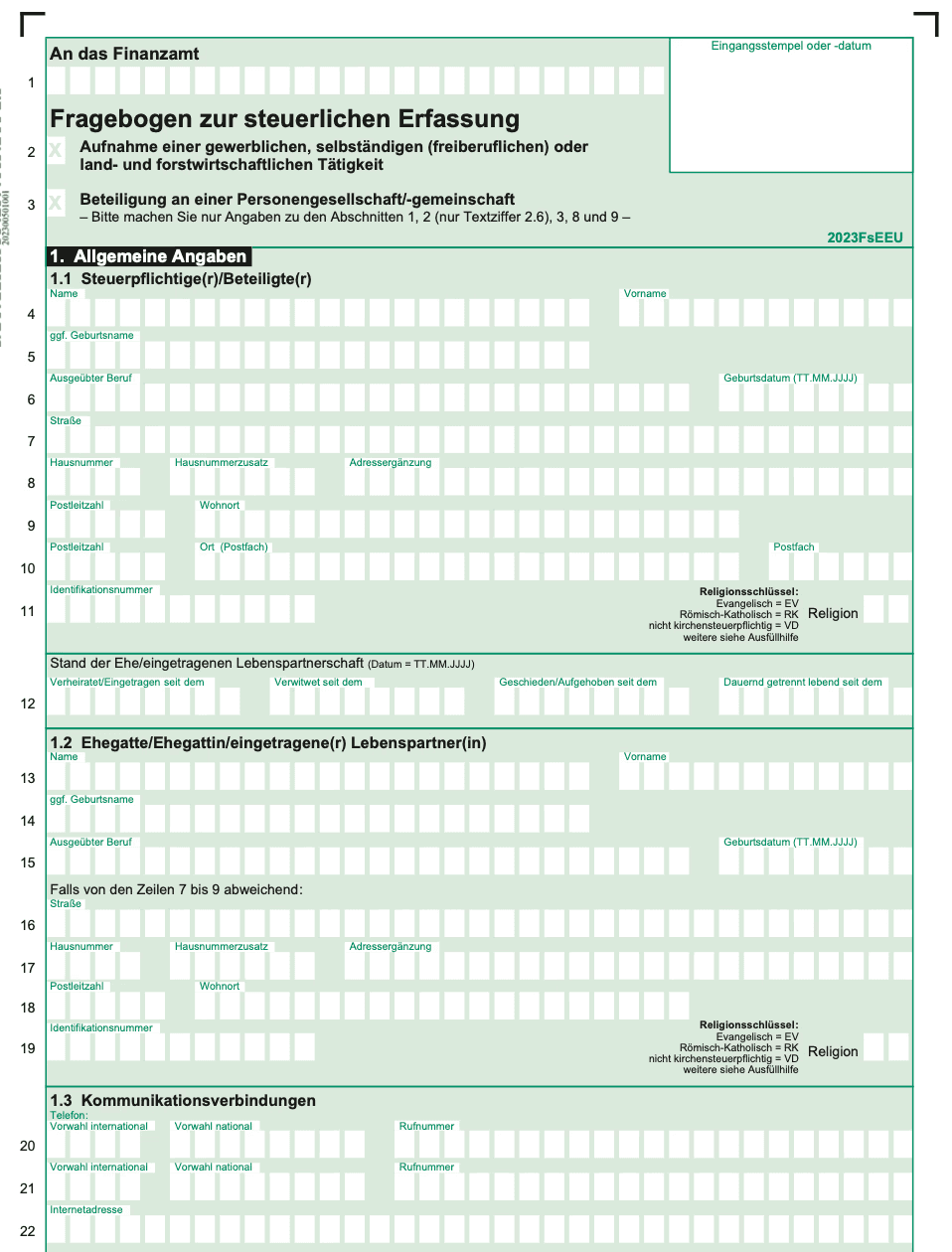

Complete the tax registration form: Fill out the "Fragebogen zur steuerlichen Erfassung" online.

Submit the form: Send it to your local Finanzamt.

Receive your tax number: Wait 3-6 weeks for your Steuernummer.

Begin working: Start your self-employed work and issue compliant invoices.

One of the example pages of the "Fragebogen zur steuerlichen Erfassung" form:

📍 Example: registering as a Freiberufler for a side hustle

Let’s say you’re a hobbyist graphic designer who bought a graphics tablet to practice on weekends. Someone discovers your work online and asks for a small, one-off project. At this stage, you don’t need to register. But as word spreads and you decide to turn it into a side hustle, here’s what you need to do:

Complete and submit the tax registration form to the Finanzamt.

Start offering your services to clients.

Once you receive your Steuernummer, include it on your invoices.

Send invoices to your customers.

Save receipts for business expenses (like your graphics tablet) to claim tax deductions.

Registering as a Gewerbetreibender

The process for Gewerbetreibende involves an additional step:

Complete the tax registration form: Same as Freiberufler.

Register a trade license: Apply for a Gewerbeschein from your local Gewerbeamt.

Receive your tax number and trade license: Use these to start your commercial activities.

😮💨 How to Easily Complete the Tax Registration Form

You don’t need pricey consultants to register as a Freiberufler. The “Fragebogen zur steuerlichen Erfassung” is available for free on the official German tax portal, Elster. Or, you can take advantage of Norman’s free tax registration form, which provides:

A user-friendly interface in 7 languages

Step-by-step instructions

Simple, relevant questions

Built-in error checking and dynamic estimates

Direct submission to the Finanzamt. No Elster account is needed

Official recognition by Elster

This is what Norman's form looks like:

Can I be both a Freiberufler and a Gewerbetreibender?

Yes, it's possible to engage in both freelance and commercial activities. However, you'll need to:

Register separately for each activity

Obtain separate tax numbers

Submit multiple tax returns (unless activities are very similar)

Key Considerations: Freiberufler vs. Gewerbetreibender

When deciding between registering as a Freiberufler or a Gewerbetreibender, consider:

Scope of Work: Intellectual/creative services (Freiberufler) vs. commercial activities (Gewerbetreibender).

Growth Ambitions: Gewerbetreibende have more options for business expansion, while Freiberufler have more flexibility and independence.

Tax Obligations: Gewerbetreibende have additional tax requirements, while Freiberufler generally have simpler tax obligations.

Freiberufler | Gewerbetreibender |

|---|---|

Focus on intellectual or creative services | Focus on commercial activities and sale of goods |

Simpler tax obligations | Additional tax requirements (e.g., trade tax) |

More flexibility and independence | Greater potential for business expansion and growth |

Costs of Registration | Costs of Registration |

Generally it is for free | Trade License Fee: €15–€100 (varies by location) |

Potential membership fees for professional associations | Trade Tax (Gewerbesteuer) |

Business insurance costs | Business insurance costs |

Paying Taxes as a Self-Employed in Germany

As a self-employed, you're responsible for managing your own taxes:

Income Tax (Einkommensteuer): Progressive rate from 14% to 45% based on annual income.

Value Added Tax (Umsatzsteuer): If annual turnover exceeds €22,000, charge VAT (usually 19%).

The Profit & Loss statement (EÜR): Defines the profit based on which you will be taxed

Zusammenfassende Meldung (ZM): Applies only to self-employed individuals with clients in the EU. It’s not a tax, but a required report.

❗Trade Tax (Gewerbesteuer): Generally only applicable to Gewerbetreibende.

Church Tax (Kirchensteuer): If applicable, about 8-9% of income tax.

Solidarity Surcharge (Solidaritätszuschlag): 5.5% of income tax.

💡 Key points:

Submit annual tax returns by July 31st of the following year.

Make quarterly advance tax payments (Vorauszahlungen) based on estimated annual income.

Keep detailed records of income and business expenses for tax deductions.

Tips for success as a self-employed in Germany

Keep Records: Maintain detailed records of all income and expenses. This will make tax time much easier and ensure you're claiming all eligible deductions.

Set Aside Money for Taxes: As a self-employed person, taxes aren't automatically deducted from your income. Set aside a portion of your earnings (around 30-40%) to cover your tax obligations.

Understand VAT Rules: If you're close to the €22,000 threshold, carefully consider whether to register for VAT. While it adds complexity, it allows you to reclaim VAT on business expenses.

Network and Join Professional Associations: These can provide valuable resources, potential clients, and support in navigating the complexities of self-employment. We at Norman are building a community of freelancers: join the community

Invest in Professional Development: Continuously improving your skills can help you stay competitive and potentially increase your earning potential.

Plan for Retirement and Healthcare: As a self-employed person, you're responsible for your own pension and health insurance. Start planning for these early.

Use Digital Tools: Invest in accounting software and digital tools like Norman to streamline your business operations and record-keeping.

Understand Client Contracts: Always have clear, written agreements with clients to avoid misunderstandings and potential legal issues.

Stay Informed About Changes: Tax laws and regulations can change. Stay updated to ensure you remain compliant. Sign up for our blog to stay notified about any changes or valuable tips.

Conclusion

Starting a self-employed career in Germany requires careful planning and understanding of the legal and tax requirements. Whether you choose to register as a Freiberufler or Gewerbetreibender depends on the nature of your work and your long-term business goals.

For more detailed information on how to start freelancing, get our free book, where we provide expert tips and a simplified roadmap for foreign entrepreneurs in this quick guide.

👏 Good luck with your self-employment journey!