An invoice is a formal document issued by you, the seller, to your client, the buyer, detailing the products or services provided and requesting payment. In the context of freelancing, an invoice is your official request for payment for the work you have completed for a client. It is a crucial component in your business's finances and compliance.

Invoices serve as legal documents that can be used to enforce payment, resolve disputes, and provide evidence of income for tax purposes. Your clients will use your invoices in their accounting, payment operations, and tax reporting.

Why freelancers must issue invoices

Legal requirement: Issuing invoices is a legal requirement for businesses, including freelancers. Invoices act as official records of transactions and ensure compliance with tax laws and regulations. You might face legal repercussions or fines from tax authorities without proper invoicing.

Proof of work and payment: Invoices provide a formal record of your services. They detail what work was done, when it was completed, and how much is owed. This is important if any disputes arise over payments or the scope of work completed.

Financial management: Invoices help you keep track of the money coming into your business, allowing you to manage your cash flow better. You will match them with incoming payments to track which clients paid for the services.

What information should your invoices include?

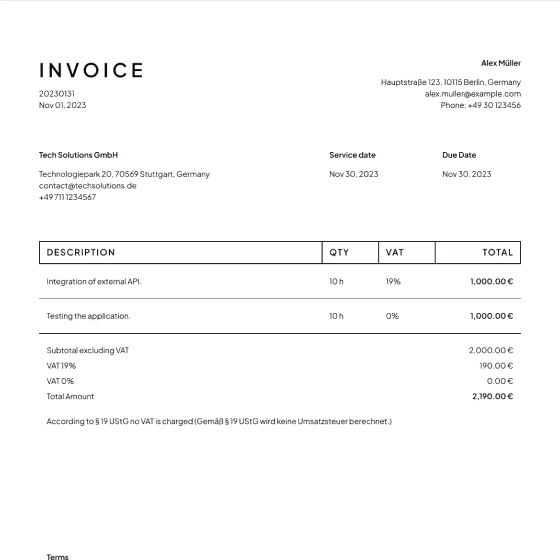

To ensure your invoices are legally compliant, they should include the following:

Your full name

Your business address (this is the address you gave when you registered your freelance business)

The full name of the person receiving the invoice (this could be the primary contact you deal with for each of your clients)

The address of the invoice recipient

Your tax number or your VAT ID

The date the invoice was created

A unique invoice number (they should be numbered consecutively)

A description of the goods delivered or services provided

The quantity or scope of the goods or services provided

The price for the goods or services listed

The date or time period in which the goods or services were rendered

The VAT rate applied to the items listed, or information on why VAT is not applied

Invoice amounts, including Net amount, VAT amount, and Gross amount

Payment instructions: Your bank account details or other payment options

You must indicate two dates on your invoice: The date you sent the invoice and the date of service provision or delivery, i.e. when you provided the service you are invoicing.

However, this is not always so easy to quantify. Clients repeatedly commission many self-employed people to perform smaller tasks over a month and prefer to issue a collective invoice at the end or beginning of the month rather than writing an invoice for each service.

You can get around this by including the following sentence on your bundled invoice:

Service date equals invoice date

Alternatively, if the customer is a recurring job, you can note the month and year, for example:

May 2024

Where relevant, you might also include the below information:

Discounts and deductions: If you offer discounts or apply deductions, clearly list them on the invoice, specifying the conditions and the resulting net amount.

Payment terms: Clearly state the payment terms on the invoice, such as the due date and any late payment penalties. In Germany, the standard payment term is 30 days from the invoice date, but you can negotiate different terms with your clients.

Notes and other terms.

What changes for Kleinunternehmen

Self-employed who earn less than € 22,000 a year may apply to be classified as "Kleinunternehmer". Anyone with this classification is exempt from the obligation to pay VAT and must not charge VAT on invoices. However, in this case, you need to add a sentence explaining why you are exempt from charging VAT. It might look something like this: Gemäß § 19 UStG wird keine Umsatzsteuer berechnet. (In accordance with §19 of the German VAT law, no VAT has been added to this invoice).

Quick facts

You're legally required to issue an invoice for any service provided.

You're obliged to keep invoices for 10 years.

You may send an invoice by post or electronically.

While it is common to use German for invoices, you can issue them in English or other languages. However, ensuring that your client understands the content is essential. You may need to provide a German translation for tax authorities.

Typically, invoices in Germany are issued in Euros (€). If you invoice in a different currency, ensure the exchange rate is clearly stated, and the VAT amount is converted to Euros.

There are fewer requirements for invoices that total less than €250 (including VAT). Still, treating these small invoices like larger ones and including all elements is a good practice.

It's best to discuss when to invoice your customers in advance. As a rule, you will send monthly invoices for regular tasks or invoice after the successful completion of a project.

What to do if there are errors on the invoice?

An error can sometimes occur in an invoice you've issued, but you can make corrections. It depends on the type of error. Typos or spelling mistakes, as long as they don't change the meaning of the invoice, don't necessarily need to be fixed.

However, if the date, invoice number, or invoice amount is incorrect, or if you forgot to include any mandatory details, you should make corrections. Otherwise, your customer won't be able to use the invoice for tax reporting.

How you proceed with a correction depends on whether the invoice has already been paid or is still outstanding.

The invoice has not been paid

You can send a corrected one if the customer still needs to pay your invoice. You use the same invoice number as on the first invoice and change the invoice date so that the legal (or your individual) payment deadline starts again.

The invoice has already been paid

Suppose you notice the error on the invoice only after the invoice has already been paid. In that case, you must issue a cancellation invoice or correction. You cannot simply adjust the error and send the same invoice again.

The cancellation invoice is a credit note. For this, you write an invoice with the negative amount of your original incorrect invoice and then issue a new, corrected invoice. The new invoice must contain a new invoice number.

International invoicing

You can have customers outside of Germany. Moreover, even 100% of your income can come from abroad. However, having German customers helps your case if you need to apply for a freelance visa. By showing that you have existing or potential clients in Germany, you demonstrate that there is local demand for your services, which supports your application.

Do I need to charge VAT to international clients?

VAT or "Umsatzsteuer" does play a role when you work for a client from abroad. However, how you treat it depends on whether your client is a company or a private person and whether they are within the EU or a country outside of the EU.

VAT within the EU – businesses and the reverse charge procedure

If your client is a business outside of Germany but still within the European Union, you and your EU-based client must have a VAT identification number, and the sale of goods or services is considered intra-community trade. In this case, it's the buyer – your client – who is obliged to pay VAT on the goods or services received, and thus you do not need to charge VAT on your invoices. This is classified as the reverse charge procedure and must be indicated as such on your invoice.

To effectively apply the reverse charge rule, your invoice must include your VAT ID number and a clear statement referring to the reverse charge procedure somewhere on the invoice. This ensures your customer can declare and reclaim the VAT when they complete their reports. A straightforward way to do this in German is by adding "Umkehrung der Steuerschuldnerschaft: Die Mehrwertsteuer ist vom Leistungsempfänger gemäß Artikel 196 der EU-Mehrwertsteuerrichtlinie zu entrichten." In English, you could state - "Services subject to the reverse charge - VAT to be accounted for by the recipient as per Article 196 of Council Directive 2006/112/EC".

VAT within the EU—private individuals

If the recipient of your goods or services does not have a VAT identification number, either because they are a private individual (as opposed to a business) or are otherwise exempt from the reverse charge rule, your invoice should include the VAT rate applicable to you according to German tax law.

VAT outside of the EU

If your client is based in a country that is not a member of the European Union, VAT is generally not charged. Some countries have a tax treaty with Germany similar to the principle reverse charge procedure. Depending on the country, there are a few other considerations to be aware of.

Example - clients in Switzerland

Germany and Switzerland have an agreement that relates to the reverse charge procedure. This means that you do not need to collect VAT when invoicing a Swiss client. Your client must report the VAT paid to the responsible Swiss tax office, and you must also declare this in your regular VAT returns, although you have not charged VAT. Your invoice should also note that it is a "non-domestic taxable service."

E-invoicing is coming

The German authorities thought, “Better late than never,” and introduced a roadmap for businesses to transition to e-invoicing. According to the plan, businesses in Germany, including self-employed, should start sending e-invoices in 2025 to get used to it, as from 2026 to 2028, e-invoicing will become mandatory for an increasing number of businesses.

Using digital invoicing solutions will also streamline your process, improve accuracy, and save time. Look for features like:

Automation of repetitive tasks, such as invoice creation and follow-ups

Real-time tracking of invoice status and payment records

Simplification of tax compliance and reporting

Integration with your existing accounting software

Customization options for branding and templates

Automated reminders and follow-up

Multi-language and multi-currency support

Norman can help you with that. It’s free, integrated into accounting/tax reports, and supports German e-invoicing standards.

What to do if the invoice wasn't paid?

Unfortunately, this happens more often with freelancers than with corporations. You will likely meet a client who is unwilling to pay during your life as a freelancer.

When do you have to react?

As soon as you get the information that the due date of an invoice has passed and you do not see any payment on your business account. If ten to fifteen days have passed since the invoice's due date and nothing has happened, it is high time to contact the client.

What is the best way to contact your client? The sustainability of your self-employment also depends on being paid on time. At the same time, the way you handle invoices and payment reminders will also influence your reputation as a freelancer. Ask yourself the right questions before you start the dunning or collection process to claim your money:

What is your relationship with the client who has not (yet) paid you?

Are they satisfied with your work so far?

How important are they in your portfolio?

Do you want a long-term relationship with them?

Let the answers to these questions guide your approach.

Start with a friendly reminder: You can pick up the phone and call your client to clarify any misunderstanding. You can also send an e-mail so that you can provide written proof. Make life easier for your client and clearly state in your message who you are and to which specific invoice you are referring.

In any case, it is too early to be too aggressive at this stage: it could simply be a "lapse" on the client's part. Your invoice may be incomplete. Encourage your client to contact you if they want to give feedback.

Your client does not respond? Now you should send a written notice ("Mahnung").

Send a written reminder now – by letter or e-mail. This time you are more decisive and remind the client of the contractual agreements that have been accepted or, even better, signed beforehand. Also, inform your client about possible interest. The remainder should contain the information that is also on the invoice. The easiest way to do this is to use the invoice template.

Still nothing? "Gerichtliches Mahnverfahren" (judicial dunning procedure) as a measure of last resort

If the payment period of 10 to 14 days set in your written notice ("Mahnung") has expired, you can decide whether you want to claim any contractual penalties that may have been agreed upon by sending a 2nd and 3rd reminder ("2. Mahnung" and "3. Mahnung") with shorter payment periods in each case. By the way, for business clients, you may charge a "Mahnpauschale" of € 40 for reminders. In the last consequence, you have the right to initiate a legal dunning procedure("Gerichtliches Mahnverfahren") to enforce your claim.

You do not necessarily have to send a 2nd or 3rd reminder to initiate these proceedings because a business client is automatically in default 30 days after the due date and receipt of an invoice (this only applies to private consumers if it is mentioned in the invoice):

"The debtor of a payment claim is in arrears at the latest if he does not pay within 30 days of the due date and receipt of an invoice or equivalent payment schedule; this applies to a debtor who is a consumer only if these consequences have been specifically pointed out in the invoice or payment schedule." (§ 286 Abs.3 BGB)

It is relatively easy to initiate this process, and if successful, the debtor must bear the costs incurred. Often the announcement of a legal dunning procedure ("Gerichtliches Mahnverfahren") is sufficient for the defaulting client to come forward. However, if the debtor objects, it can take quite a while before the claim can be enforced. And, of course, only if the debtor is solvent.

The enforcement, according to the "Gerichtliche Mahnverfahren," works as follows:

Apply online for an order for payment.

Now a court formally examines the request for completeness and issues a dunning notice.

The debtor's behavior determines whether the dunning procedure will end in court. If the debtor does not object, the enforcement order follows. The order is legally binding if there is no objection in this step. If an objection is lodged, the order for payment procedure ultimately takes the parties to court.

After the court order has been served, the client has 14 days to lodge an objection. After that, you can still decide whether to pursue your claim in a lawsuit.

If there is no objection, you can directly receive an enforcement order and have the claim enforced by a bailiff.

“Gerichtliches Mahnverfahren”? Bailiffs? Lawyers? Judicial or extrajudicial proceedings? You decide how much time and money you want to invest in collecting your bill and whether you are prepared to take your client to court and jeopardize a business relationship. In any case, you will need some patience. Here's a golden rule at the end: Don't leave these issues lying around. The longer you hesitate, the less you want to deal with them, and the less likely you will get your money.

Incoming invoices

Managing incoming invoices is the second half of the accounting. All invoices received must be complete and contain all the necessary components to be officially logged as incoming invoices because only the proper invoices can be used for tax deductions in Germany.

What is an incoming invoice?

An incoming invoice is any invoice that is issued to you. This can be the receipt for a restaurant visit with a client or a new business expense invoice, like a computer or phone.

You are legally obliged to keep your receipts for 10 years. This way, you can easily prove to the tax authorities the VAT you have paid and reclaimed, even in the event of any queries at a later date.

Missing invoices can have consequences for you and your business. And incorrect incoming invoices where, for example, some mandatory information has not been included can lead to additional payments to the Finanzamt.

Conclusion

Correct invoicing is crucial for freelancers to ensure smooth financial operations and compliance with legal requirements. By issuing clear and accurate invoices, you safeguard your income. Remember to keep thorough records, stay on top of unpaid invoices promptly, and utilize digital solutions to streamline the process. As you navigate the complexities of invoicing, tools like Norman can offer invaluable support, helping you focus more on your work and less on administrative tasks.