Turn your passion

into a thriving

business

EÜR, income tax, VAT, Gewerbe tax, and ZM.

Save 8h/month with AI autopilot.

Freelance registration, invoicing, and much more.

MEET NORMAN

MEET NORMAN

MEET NORMAN

Only 1/3 of self-employed in Germany are women.

Norman is a dedicated financial assistant, here to empower and support ambitious women entrepreneurs.

Only 1/3 of self-employed in Germany are women.

Norman is a dedicated financial assistant, here to empower and support ambitious women entrepreneurs.

Built in Germany for

Designers

Developers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Hear from fellow freelancers

Hear from fellow freelancers

Hear from fellow freelancers

Accounting for the next generation of self-employed

Stop spending hours on accounting, invoice collection, and taxes.

Stop spending hours on accounting, invoice collection, and taxes.

Stop spending hours on accounting, invoice collection, and taxes.

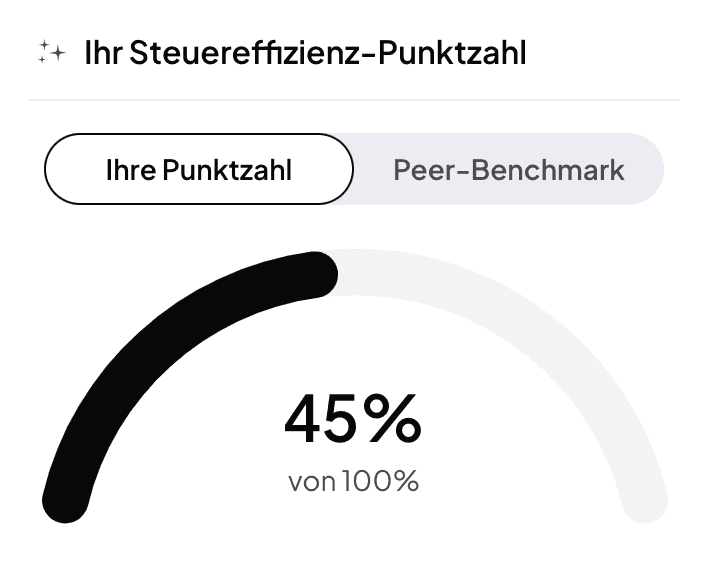

Maximize tax deductions

Maximize tax deductions

Norman auto-finds deductibles and provides personalized tips.

Norman auto-finds deductibles and provides personalized tips.

Effortless tax declarations

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

All declarations are already filled out. Submit directly to the tax office.

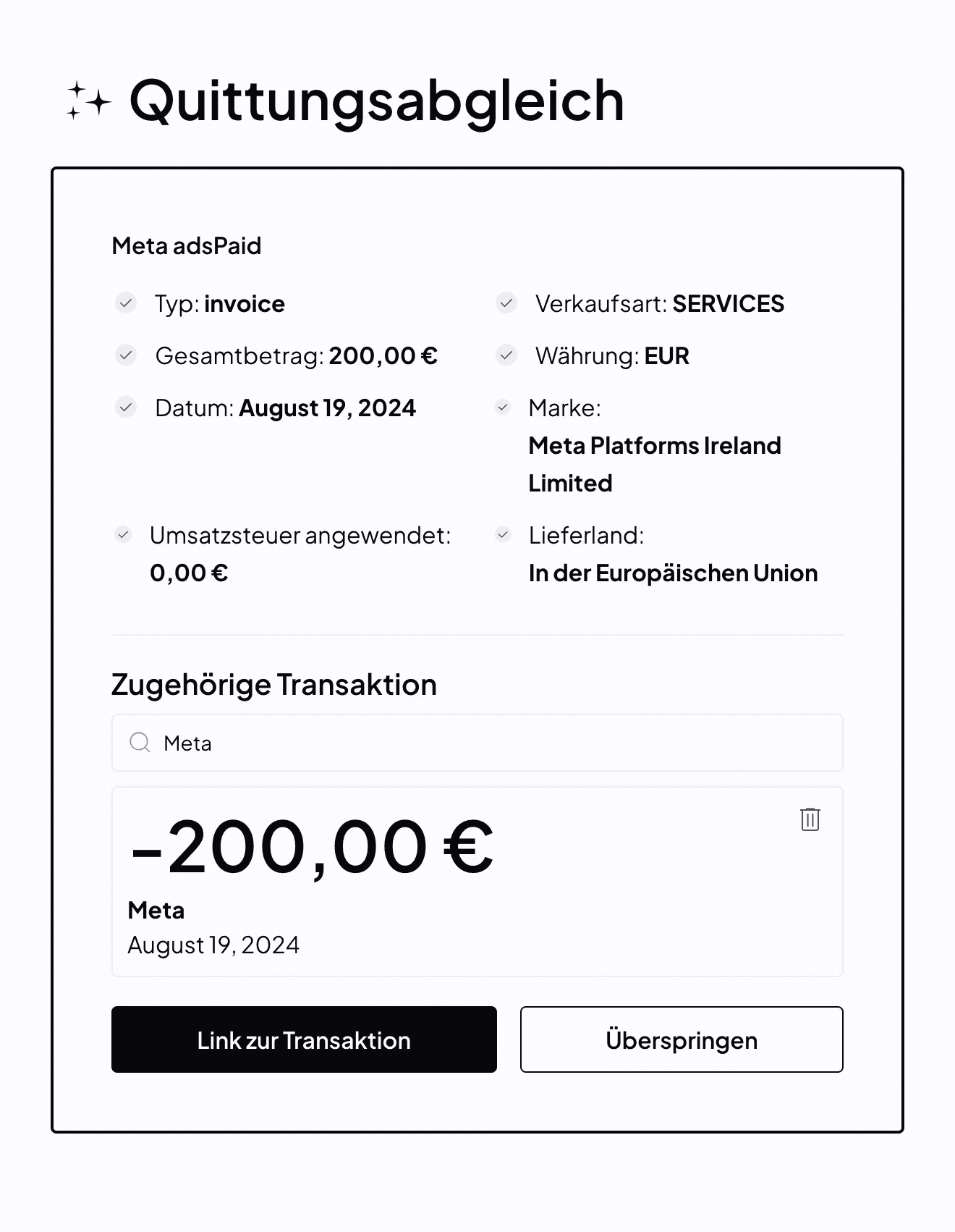

No more manual work

No more manual work

Instantly match uploaded receipts with transactions.

Instantly match uploaded receipts with transactions.

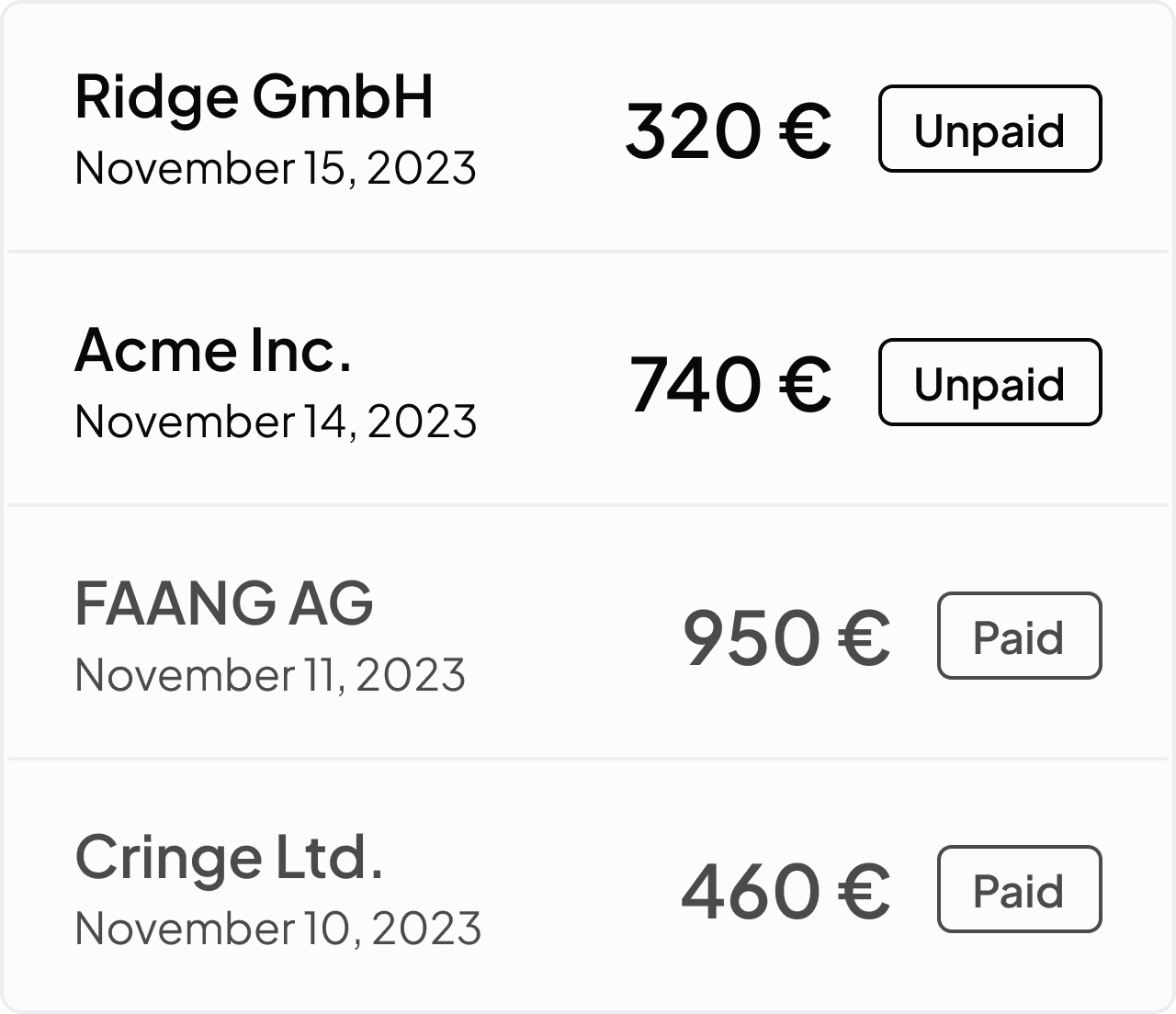

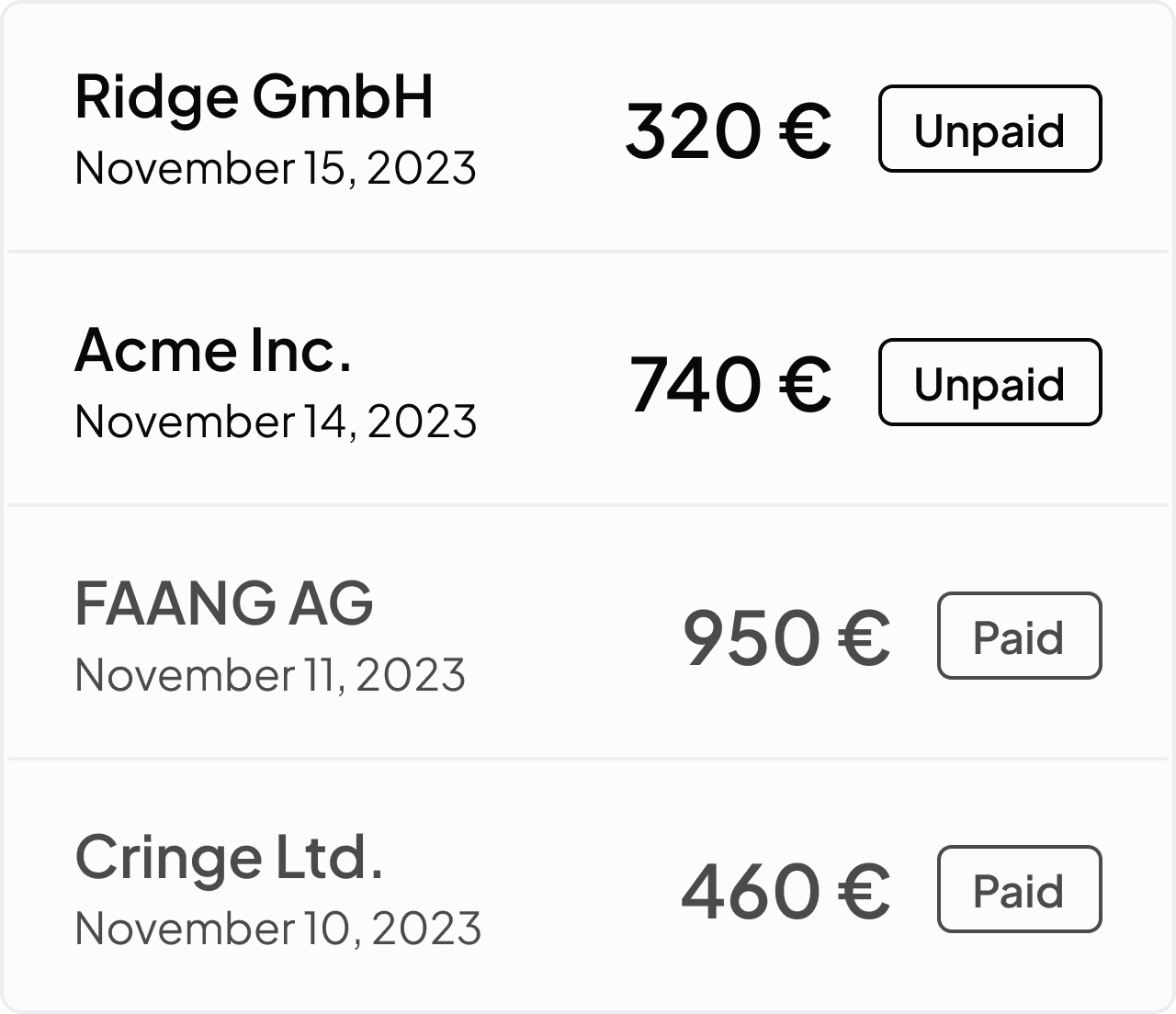

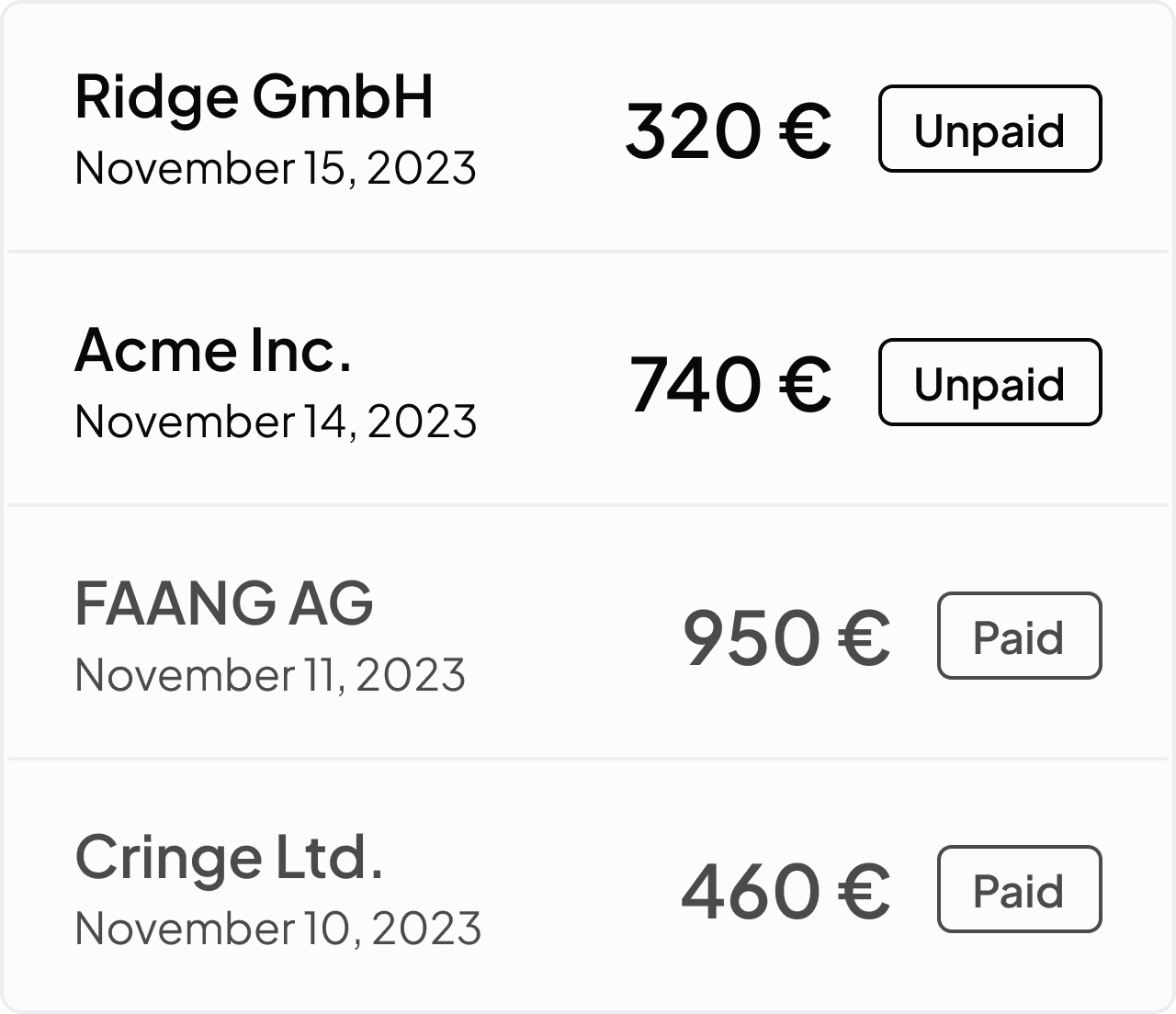

Easy e-invoicing

Easy e-invoicing

Create compliant invoices and automatically track payment statutes.

Create compliant invoices and automatically track payment statutes.

Always up-to-date

Always up-to-date

Know the next deadline and see your tax burden change in real-time.

Know the next deadline and see your tax burden change in real-time.

Bank sync

AI advisor

Voice invoicing

Start for free

Wow support

Spend less on accounting

Spend less on accounting

Spend less on accounting

Save time thanks to the Norman AI co-pilot. Stop spending hours on taxes, invoices, and collecting receipts.

Save time thanks to the Norman AI co-pilot. Stop spending hours on taxes, invoices, and collecting receipts.

Get finance superpowers with Norman AI co-pilot. Stop spending hours on taxes, invoices, and receipt collection.

3 150 €

3 150 €

3 150 €

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

8 hours

8 hours

8 hours

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Stress

Stress

Stress

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

Learn more about taxes and finance in our blog.

At Norman, the essentials are free.

Free

Ideal for individuals who need quick access to basic features

0

€

/month

(excl. VAT)

Zero manual entries (bank sync)

Smart invoicing

Deductibles tips and guidance

Receipt management

Get Started

Free

Ideal for individuals who need quick access to basic features

0

€

/month

(excl. VAT)

Zero manual entries (bank sync)

Smart invoicing

Deductibles tips and guidance

Receipt management

Get Started

Free

Ideal for individuals who need quick access to basic features

0

€

/month

(excl. VAT)

Zero manual entries (bank sync)

Smart invoicing

Deductibles tips and guidance

Receipt management

Get Started

Small

Yearly (3 months free)

For Kleinunternehmer with less than €22.000 revenue per year.

7

€

/month

(excl. VAT)

Profit and loss statement (EÜR)

Smart invoicing

Personal income tax return

Receipt auto-matching

Get Started

Small

Yearly (3 months free)

For Kleinunternehmer with less than €22.000 revenue per year.

7

€

/month

(excl. VAT)

Profit and loss statement (EÜR)

Smart invoicing

Personal income tax return

Receipt auto-matching

Get Started

Small

Yearly (3 months free)

For Kleinunternehmer with less than €22.000 revenue per year.

7

€

/month

(excl. VAT)

Profit and loss statement (EÜR)

Smart invoicing

Personal income tax return

Receipt auto-matching

Get Started

Business

Yearly (3 months free)

For Gewerbetreibende and Freelancers that charge VAT

22

€

/month

(excl. VAT)

VAT reports

EÜR and annual filings

Receipt auto-matching

Norman AI co-pilot

Get Started

Business

Yearly (3 months free)

For Gewerbetreibende and Freelancers that charge VAT

22

€

/month

(excl. VAT)

VAT reports

EÜR and annual filings

Receipt auto-matching

Norman AI co-pilot

Get Started

Business

Yearly (3 months free)

For Gewerbetreibende and Freelancers that charge VAT

22

€

/month

(excl. VAT)

VAT reports

EÜR and annual filings

Receipt auto-matching

Norman AI co-pilot

Get Started

We are building a community of freelancers

We are building a community of freelancers

We are building a community of freelancers

Free

Free

Free

Free participation, materials, webinars, and events.

Free participation, materials, webinars, and events.

Free participation, materials, webinars, and events.

Practical

Practical

Practical

Discussions around tax deductibles and growth hacks.

Discussions around tax deductibles and growth hacks.

Discussions around tax deductibles and growth hacks.

Open

Open

Open

Inclusive for all backgrounds and diverse professions.

Inclusive for all backgrounds and diverse professions.

Inclusive for all backgrounds and diverse professions.

FAQ

What exactly is Norman?

Norman is the Accounting Autopilot for modern entrepreneurs. It helps minimize audit risk and save money. Our mission is to make your everyday business life as easy as possible.

I am not self-employed. Can I file my income tax through Norman?

Yes! Norman supports salary from employment, donations, joint filings, etc. Still, we don't cover 100% of cases (e.g., solar installation subsidies).

Can I really do it myself?

Yes! If you use Norman, you usually don't need a tax advisor or accountant. Our mission is to make tax filing more accessible, faster, and less stressful. Thousands of individuals, self-employed, and businesses file their taxes without a Steuerberater. Many even do it on Elster, where it can be challenging to understand the questions and whether they are relevant to you. Norman endorses the official Elster portal.

How much does Norman cost?

The income tax submission for individuals costs €35. The self-employment registration form, smart invoicing, and bookkeeping are free. The monthly plans for self-employed start at €11/€22 for Kleinunternehmen/VAT payers.

Does Norman support freelancers and Gewerbetreibende:r?

Yes! We equally support Kleinunternehmer, Freiberufler, and Gewerbetreibende. You can submit the Gewerbesteuererklärung (Trade tax declaration) with Norman.

Can I trust my data with Norman?

Yes! Norman adheres to German data privacy requirements and stores your data only in data centers located in Frankfurt. When you connect a bank account, Norman NEVER sees the credentials used. Bank connection is provided by a PSD2 licensed Open Banking provider.

Does AI make a difference?

Yes! Modern AI models are extremely good at categorization and extracting information from documents (like VAT from a receipt). We assembled a collection of best-in-class models to save you hours on bookkeeping and tax filing. We've tuned the top-notch language model to work specifically with German tax law. Still, Norman can make mistakes. Check important information.

What exactly is Norman?

Norman is the Accounting Autopilot for modern entrepreneurs. It helps minimize audit risk and save money. Our mission is to make your everyday business life as easy as possible.

I am not self-employed. Can I file my income tax through Norman?

Yes! Norman supports salary from employment, donations, joint filings, etc. Still, we don't cover 100% of cases (e.g., solar installation subsidies).

Can I really do it myself?

Yes! If you use Norman, you usually don't need a tax advisor or accountant. Our mission is to make tax filing more accessible, faster, and less stressful. Thousands of individuals, self-employed, and businesses file their taxes without a Steuerberater. Many even do it on Elster, where it can be challenging to understand the questions and whether they are relevant to you. Norman endorses the official Elster portal.

How much does Norman cost?

The income tax submission for individuals costs €35. The self-employment registration form, smart invoicing, and bookkeeping are free. The monthly plans for self-employed start at €11/€22 for Kleinunternehmen/VAT payers.

Does Norman support freelancers and Gewerbetreibende:r?

Yes! We equally support Kleinunternehmer, Freiberufler, and Gewerbetreibende. You can submit the Gewerbesteuererklärung (Trade tax declaration) with Norman.

Can I trust my data with Norman?

Yes! Norman adheres to German data privacy requirements and stores your data only in data centers located in Frankfurt. When you connect a bank account, Norman NEVER sees the credentials used. Bank connection is provided by a PSD2 licensed Open Banking provider.

Does AI make a difference?

Yes! Modern AI models are extremely good at categorization and extracting information from documents (like VAT from a receipt). We assembled a collection of best-in-class models to save you hours on bookkeeping and tax filing. We've tuned the top-notch language model to work specifically with German tax law. Still, Norman can make mistakes. Check important information.

What exactly is Norman?

Norman is the Accounting Autopilot for modern entrepreneurs. It helps minimize audit risk and save money. Our mission is to make your everyday business life as easy as possible.

I am not self-employed. Can I file my income tax through Norman?

Yes! Norman supports salary from employment, donations, joint filings, etc. Still, we don't cover 100% of cases (e.g., solar installation subsidies).

Can I really do it myself?

Yes! If you use Norman, you usually don't need a tax advisor or accountant. Our mission is to make tax filing more accessible, faster, and less stressful. Thousands of individuals, self-employed, and businesses file their taxes without a Steuerberater. Many even do it on Elster, where it can be challenging to understand the questions and whether they are relevant to you. Norman endorses the official Elster portal.

How much does Norman cost?

The income tax submission for individuals costs €35. The self-employment registration form, smart invoicing, and bookkeeping are free. The monthly plans for self-employed start at €11/€22 for Kleinunternehmen/VAT payers.

Does Norman support freelancers and Gewerbetreibende:r?

Yes! We equally support Kleinunternehmer, Freiberufler, and Gewerbetreibende. You can submit the Gewerbesteuererklärung (Trade tax declaration) with Norman.

Can I trust my data with Norman?

Yes! Norman adheres to German data privacy requirements and stores your data only in data centers located in Frankfurt. When you connect a bank account, Norman NEVER sees the credentials used. Bank connection is provided by a PSD2 licensed Open Banking provider.

Does AI make a difference?

Yes! Modern AI models are extremely good at categorization and extracting information from documents (like VAT from a receipt). We assembled a collection of best-in-class models to save you hours on bookkeeping and tax filing. We've tuned the top-notch language model to work specifically with German tax law. Still, Norman can make mistakes. Check important information.

© 2025 Norman AI GmbH

© 2025 Norman AI GmbH

© 2025 Norman AI GmbH