Einnahmenüberschussrechnung (EÜR) for Kleinunternehmer: 2026 guide

Diana

Updated on:

Oct 6, 2025

Spoilers to the article:

Can Kleinunternehmer submit EÜR?

Yes.

Should Kleinunternehmer submit EÜR?

Yes, for simplicity.

For a Kleinunternehmer (small business owner) in Germany, the Einnahmenüberschussrechnung (EÜR) is a straightforward accounting and tax compliance method. This guide offers a comprehensive overview of the EÜR for Kleinunternehmer, from eligibility criteria to step-by-step preparation, to ensure accurate financial reporting without unnecessary complexity.

What is the Einnahmenüberschussrechnung (EÜR)?

The Einnahmenüberschussrechnung (EÜR) is a simplified method for calculating profits. It is available to all Kleinunternehmer and is exempt from double-entry bookkeeping and balance sheet requirements. The principle is straightforward: operating income and expenses are listed and offset against each other, resulting in the net profit or loss for the period.

Who is required to submit an EÜR?

As an entrepreneur, you must determine and report your revenues and the resulting profit or loss to the tax office. The EÜR is a standard method of profit determination for eligible self-employed individuals, including Kleinunternehmer.

Eligibility Criteria:

All freelancers: Generally allowed to use the EÜR to determine profit.

Kleingewerbe: Gewerbetreibende that do not exceed specific revenue and profit thresholds. Thresholds:

Annual revenue: Up to 800.000 € and

Annual profit: Up to 80.000 €

If these thresholds are exceeded, switching to double-entry bookkeeping and balance sheet preparation is obligatory. However, this obligation only takes effect after notification from the tax office, which may take up to two years due to reporting timelines.

⚡ If you are a Kleinunternehmer - you are always eligible for EÜR reporting.

Key rules for the EÜR as a Kleinunternehmer

The legal basis for the EÜR is found in the German Income Tax Act (§ 4 Abs. 3 EStG), which defines it as the "surplus of operating income over operating expenses." This provision allows Kleinunternehmer to use the EÜR for profit determination, provided they adhere to the specified revenue and profit limits.

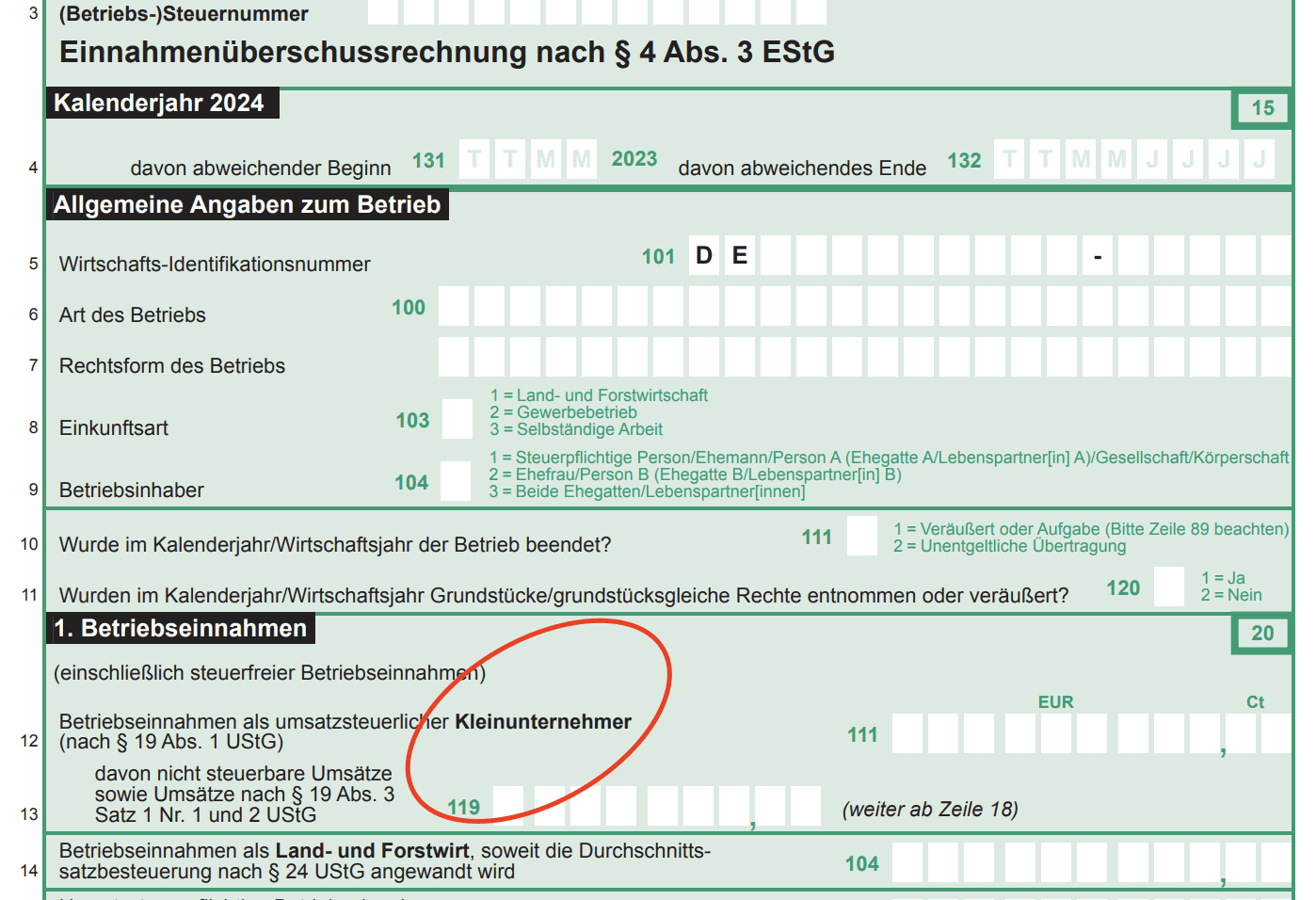

Mandatory use of "Anlage EÜR": Since 2017, all individuals using the EÜR must electronically submit the standardized form "Anlage EÜR" to the tax office. Previously, informal reporting was sufficient, but now, electronic submission via the ELSTER portal or an accounting software connected to Elster is required.

Submission deadlines: The EÜR and the income tax return must be submitted by July 31 of the following year. Missing this deadline may result in late fees or penalties.

Advantages of using the EÜR for Kleinunternehmer

The EÜR is less complex than double-entry bookkeeping, making it faster and easier to complete for Kleinunternehmer and VAT-liable self-employed.

Time and cost savings can be significant. EÜR requires less preparation time, allowing entrepreneurs to focus on core business activities. It also reduces the need for extensive accounting services, saving thousands of euros annually.

A step-by-step guide to preparing the EÜR as a Kleinunternehmer

Accurate preparation of the EÜR involves several key steps:

Collect and organize financial records:

Operating income: Collect invoices for all business-related income, including sales revenue, service fees, and other earnings.

Kleinunternehmer have a dedicated field for income in the EÜR declaration.

Operating expenses: Record all deductible business expenses, such as rent, utilities, office supplies, travel costs, and professional fees.

Apply the cash basis accounting principle:

The EÜR follows the cash accounting method, meaning income and expenses are recorded when cash is received or paid, not invoiced. This is known as the "Zu- und Abflussprinzip" (inflow and outflow principle).

With cash accounting, you won't pay income tax on the revenue you haven't actually received.

Use ELSTER or Norman for submission:

Access the ELSTER online portal and complete the "Anlage EÜR" form. Ensure all entries are accurate and correspond to your financial records.

ELSTER is entirely free and available to all taxpayers in Germany. Unfortunately, ELSTER won't help you calculate the total revenue and expense for every category and clean the calculations from VAT.

Tools like Norman help you keep the records for potential audits from Finanzamt and automate tax calculations.

Maintain supporting documentation:

Keep all invoices, receipts, and financial documents organized and accessible, as they may be required for verification by the tax office.

Even Kleinunternehmer must keep all the business-related documents for 8 years.

Common pitfalls to avoid:

Incomplete record-keeping: Ensure all income and expenses are thoroughly documented with corresponding receipts or invoices.

Incorrect application of the cash basis principle: Only record transactions when payment is received or made, not when invoiced.

Late submission: Adhere to submission deadlines to avoid penalties. Late submission can lead to fines and penalties, significantly impacting your business's financial health.

What expenses can Kleinunternehmer deduct in EÜR?

One of the key advantages of using the EÜR is the ability to deduct business-related expenses from taxable income. Relevant deductions significantly reduce your overall tax liability.

Here are some common deductible expenses:

Office & home office

Office rent & utilities – If you rent a separate office space.

Home Office deduction – If your workspace meets the tax office's home office criteria.

Equipment & supplies

Laptops, Printers, and Workstations – Fully deductible if used for business.

Office supplies – Paper, pens, and general stationery.

Business travel & transportation

Mileage allowance – If you use a private vehicle for business (€0.30 per km).

Public transport & taxis – When traveling for work-related purposes.

Accommodation & per diem rates – If attending business events.

Marketing & advertising

Website costs – Hosting, domain fees, and web design.

Advertising – Google Ads, social media ads, flyers, and business cards.

Software

Invoicing and accounting software - Norman.

Project management and note-taking - Notion.

Office suite - Microsoft Office (Microsoft 365 or whatever the current name is)

Professional fees

Legal fees – If you hire a lawyer for consulting or to create documents for the business.

Memberships & certifications – If necessary for your profession.

Insurance & employee costs

Professional liability insurance

Health insurance contributions

Freelancer Social Security Contributions

💸 Keeping clear records of deductible expenses maximizes tax benefits and reduces taxable income.

Automate EÜR preparation with Norman

Managing EÜR manually can be time-consuming and error-prone. Norman makes your EÜR submission effortless.

How Norman helps:

✅ Automatic income & expense tracking – Connect your bank account and let Norman categorize transactions.

✅ VAT сompliance – Norman knows how to deal with input VAT whether you are a Kleinunternehmer or not.

✅ Pre-filled Anlage EÜR – Norman auto-generates your EÜR and submits it directly to the Finanzamt—no need to duplicate your work on Elster or hire a tax advisor.

✅ Digital document storage – Upload receipts and invoices directly into the system for easy reference.

✅ Deadline reminders – Never miss your tax filing deadlines again.

Using Norman, Kleinunternehmer can save hours on bookkeeping and avoid costly mistakes—allowing you to focus on growing your business rather than dealing with tax paperwork.

Conclusion

The Einnahmenüberschussrechnung (EÜR) offers Kleinunternehmer a streamlined and efficient method for profit determination. By understanding the eligibility criteria, adhering to key rules, and following a systematic preparation process, small business owners can ensure accurate financial reporting and maintain compliance with German tax regulations.

This article is intended to provide general information and does not constitute tax advice.