All your taxes

on autopilot

Whether you're a freelancer or a Gewerbe - your income tax, EÜR, and VAT are created automatically. Write invoices and much more.

Built in Germany for

Designers

Developers

Etsy sellers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Etsy sellers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Designers

Developers

Etsy sellers

Freelancers

Consultants

Photographers

Expats

Self-employed

Lawyers

Copywriters

Gewerbe

Hear from fellow freelancers

Accounting for the next generation of self-employed

Accounting for the next generation of self-employed

Accounting for the next generation of self-employed

Stop spending hours on accounting, invoice collection, and taxes.

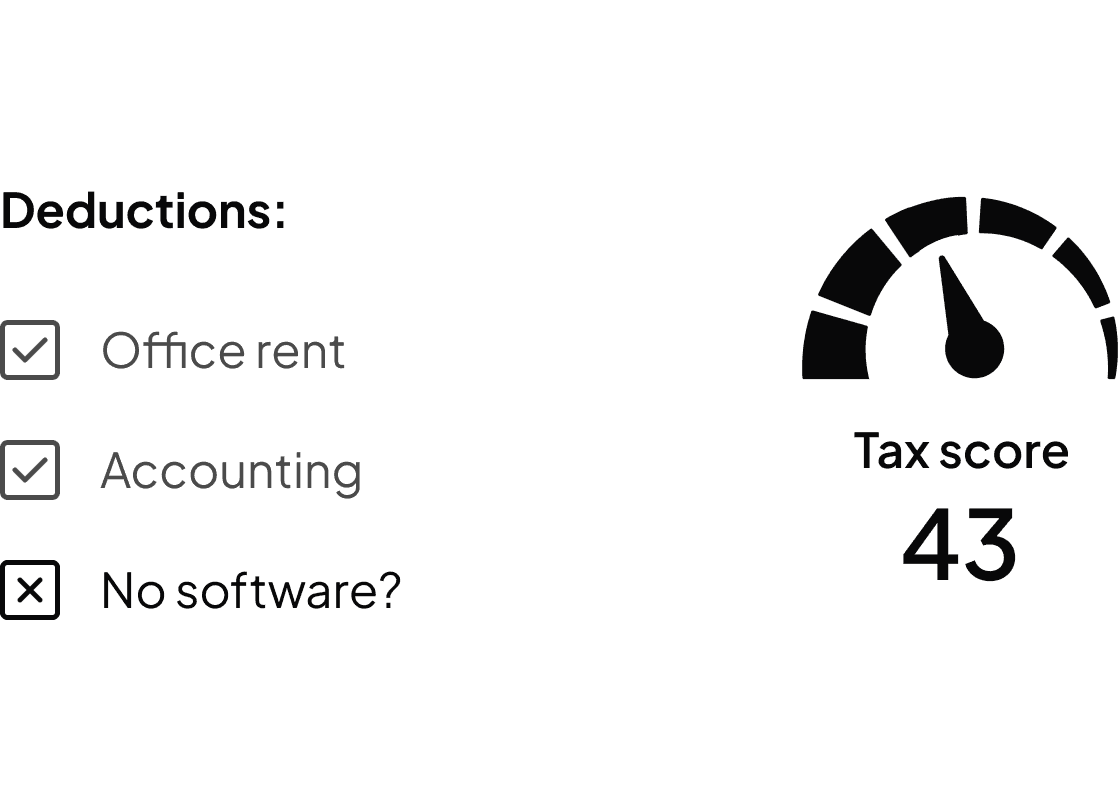

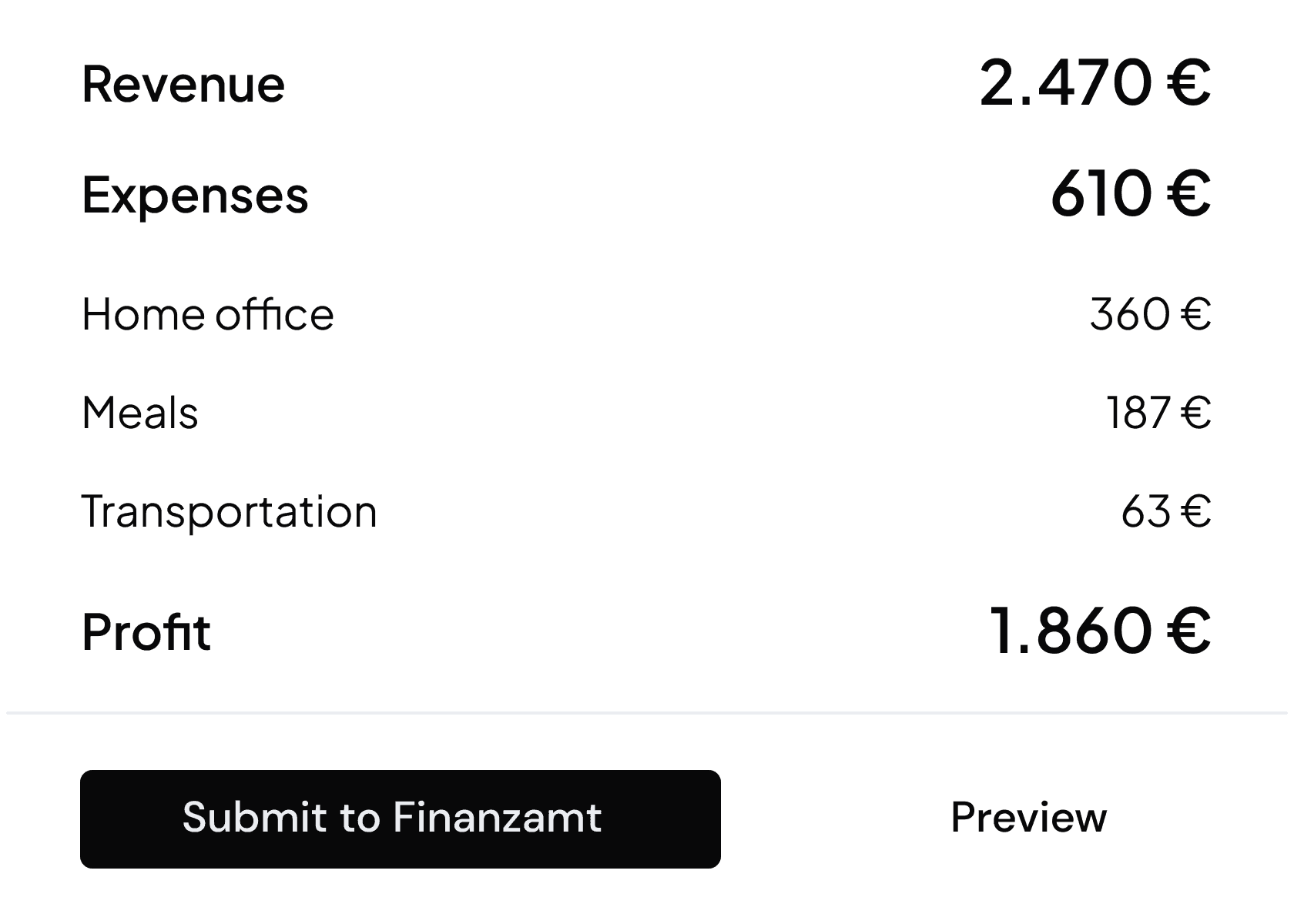

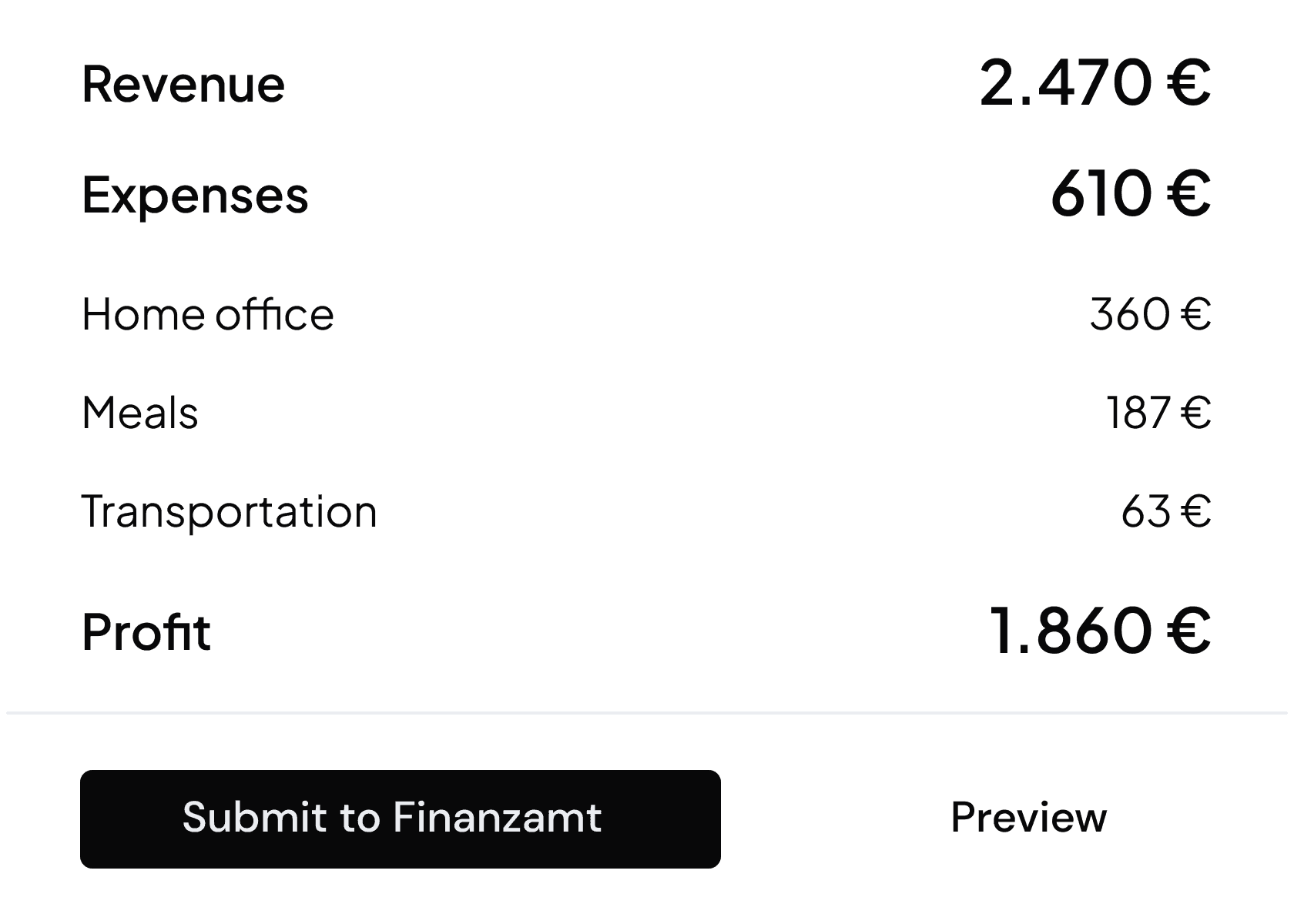

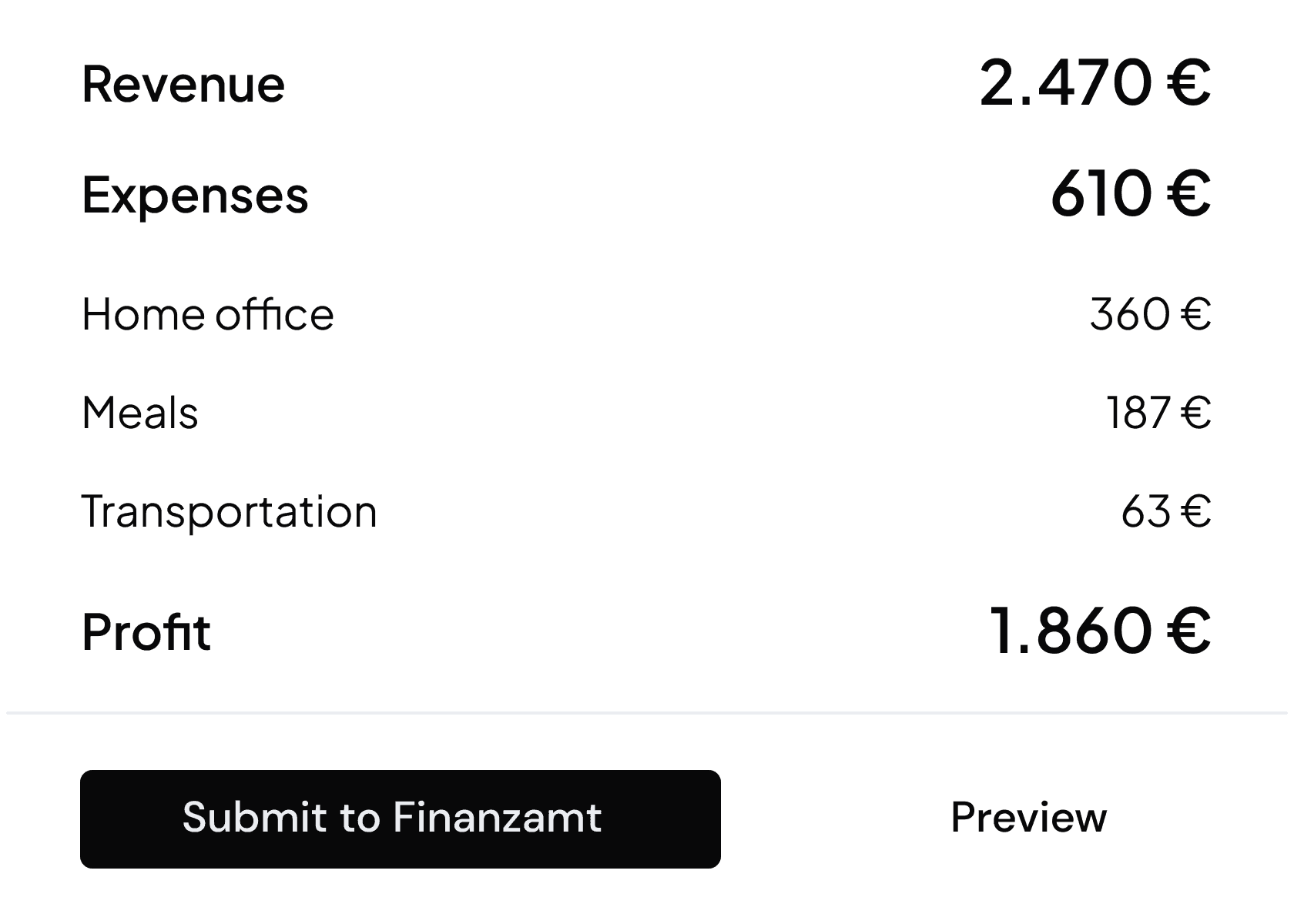

Maximize tax deductions

Norman auto-finds tax write-offs and shows personalized savings tips.

Maximize tax deductions

Norman auto-finds tax write-offs and shows personalized savings tips.

Maximize tax deductions

Norman auto-finds tax write-offs and shows personalized savings tips.

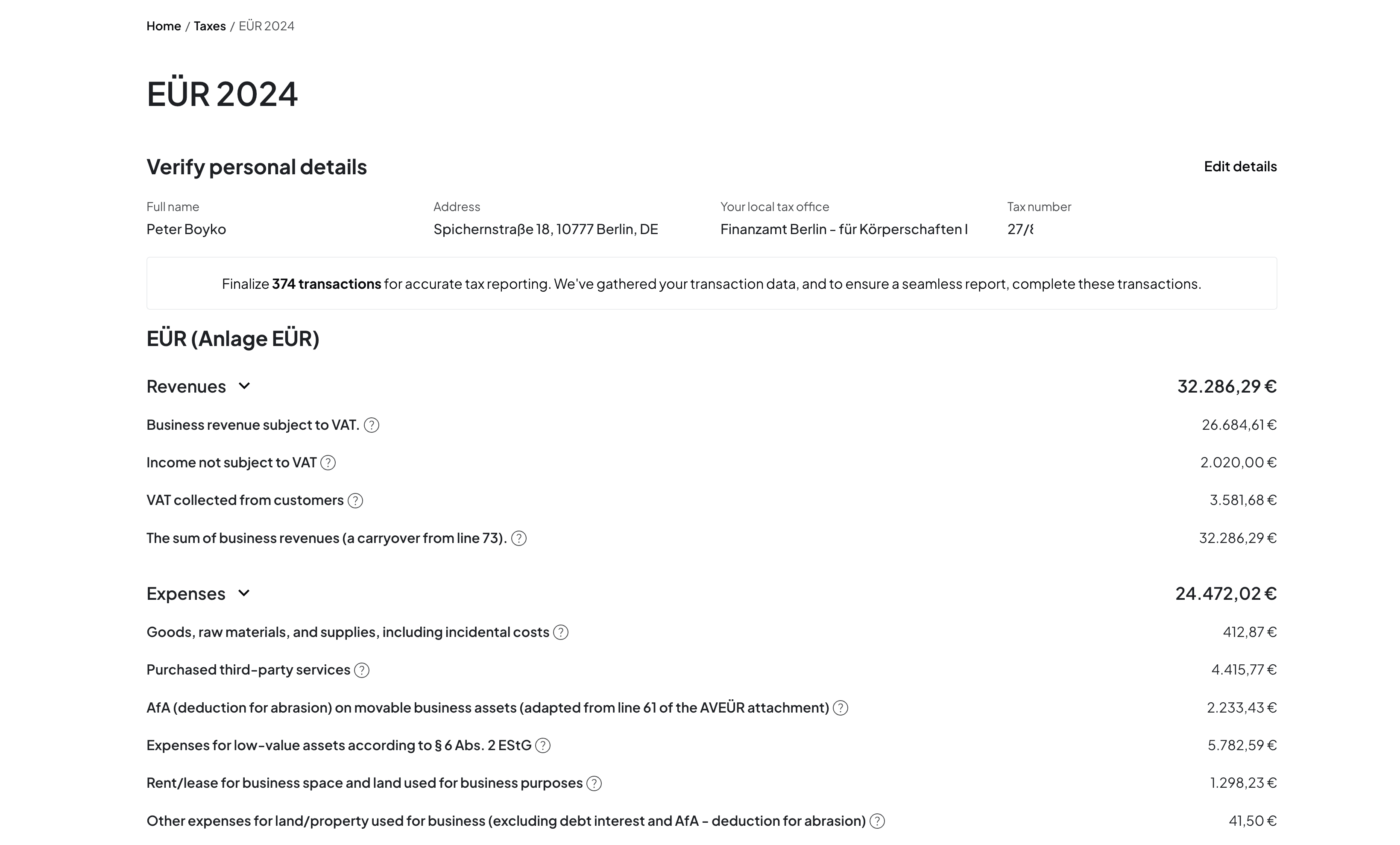

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

Effortless tax declarations

All declarations are already filled out. Submit directly to the tax office.

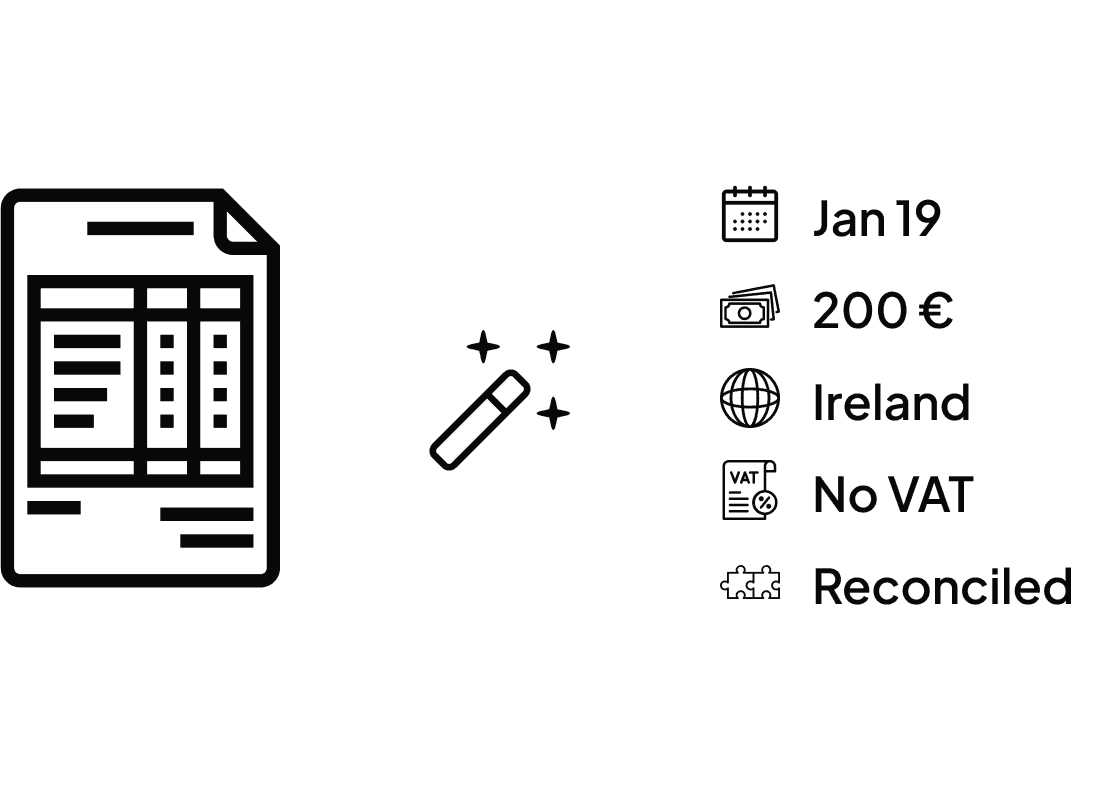

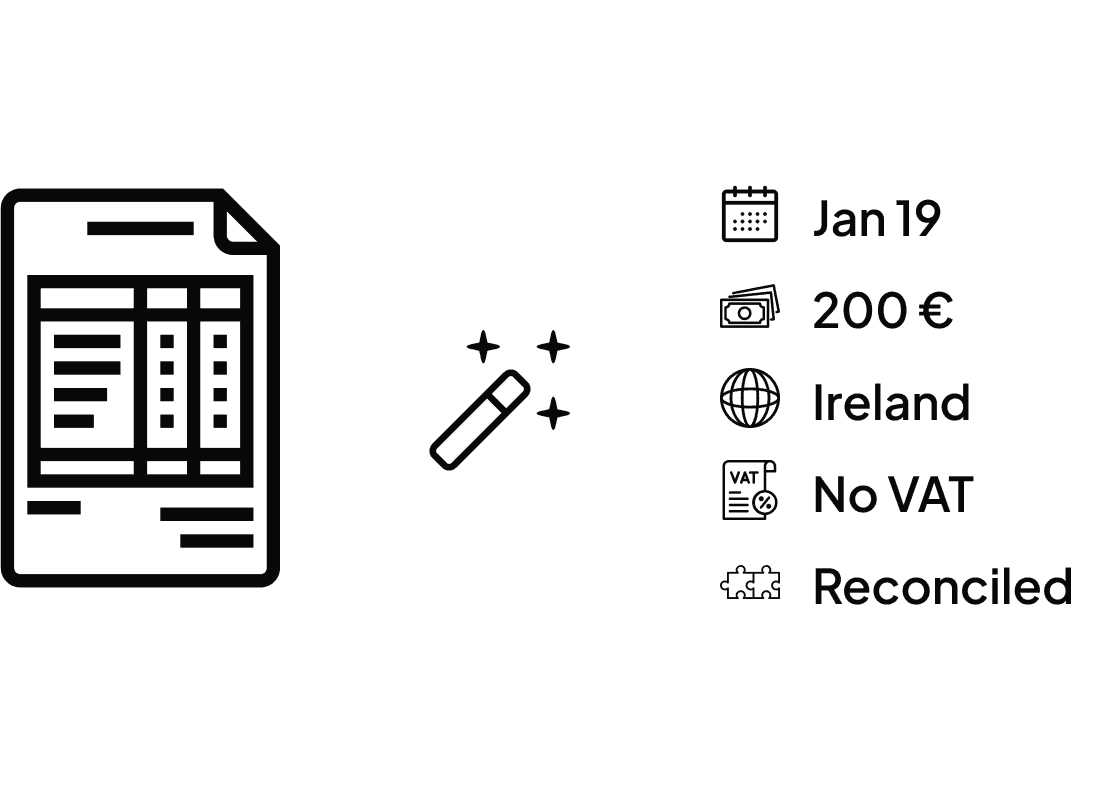

No manual work

Instantly match uploaded receipts with transactions.

No manual work

Instantly match uploaded receipts with transactions.

No manual work

Instantly match uploaded receipts with transactions.

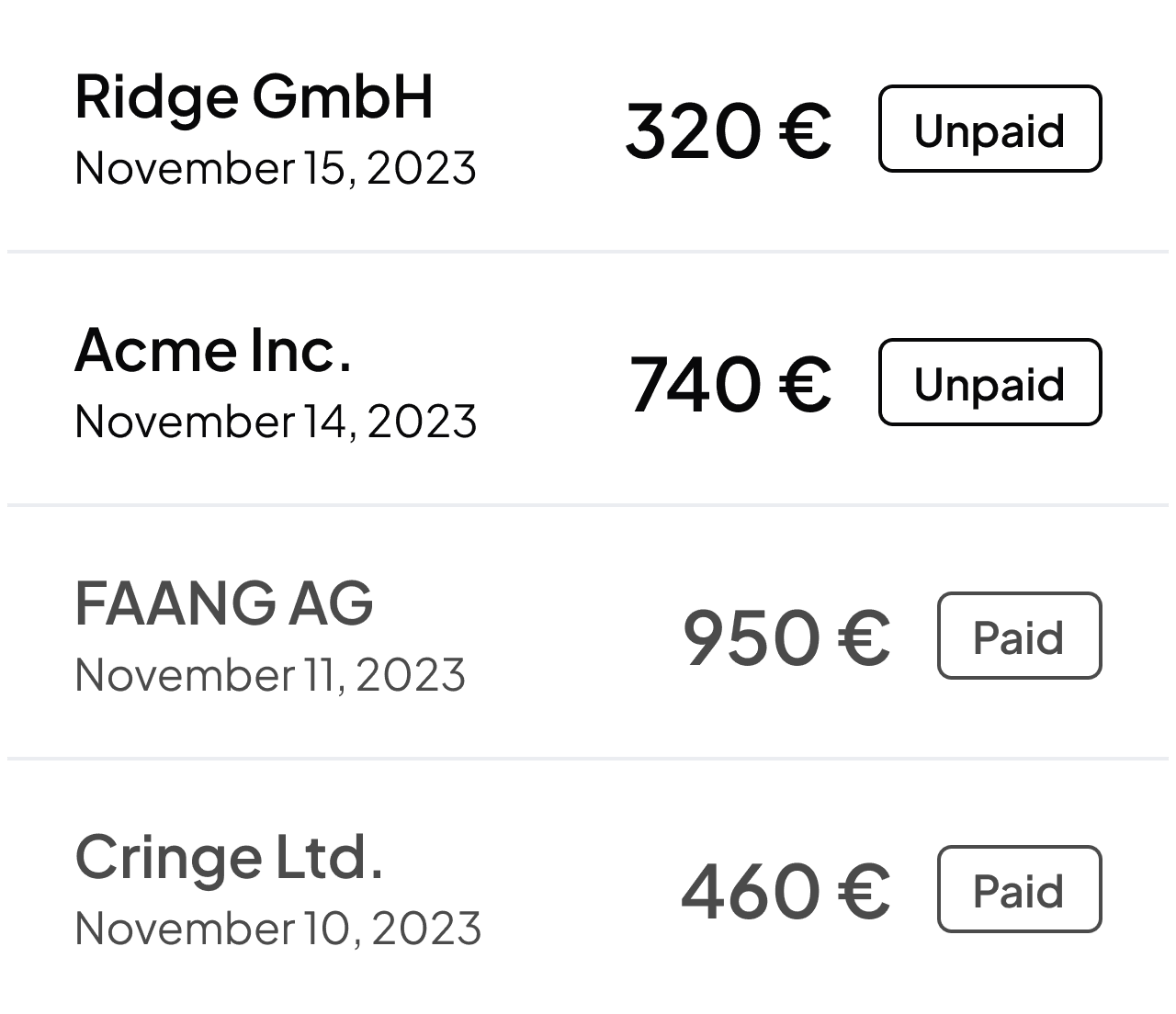

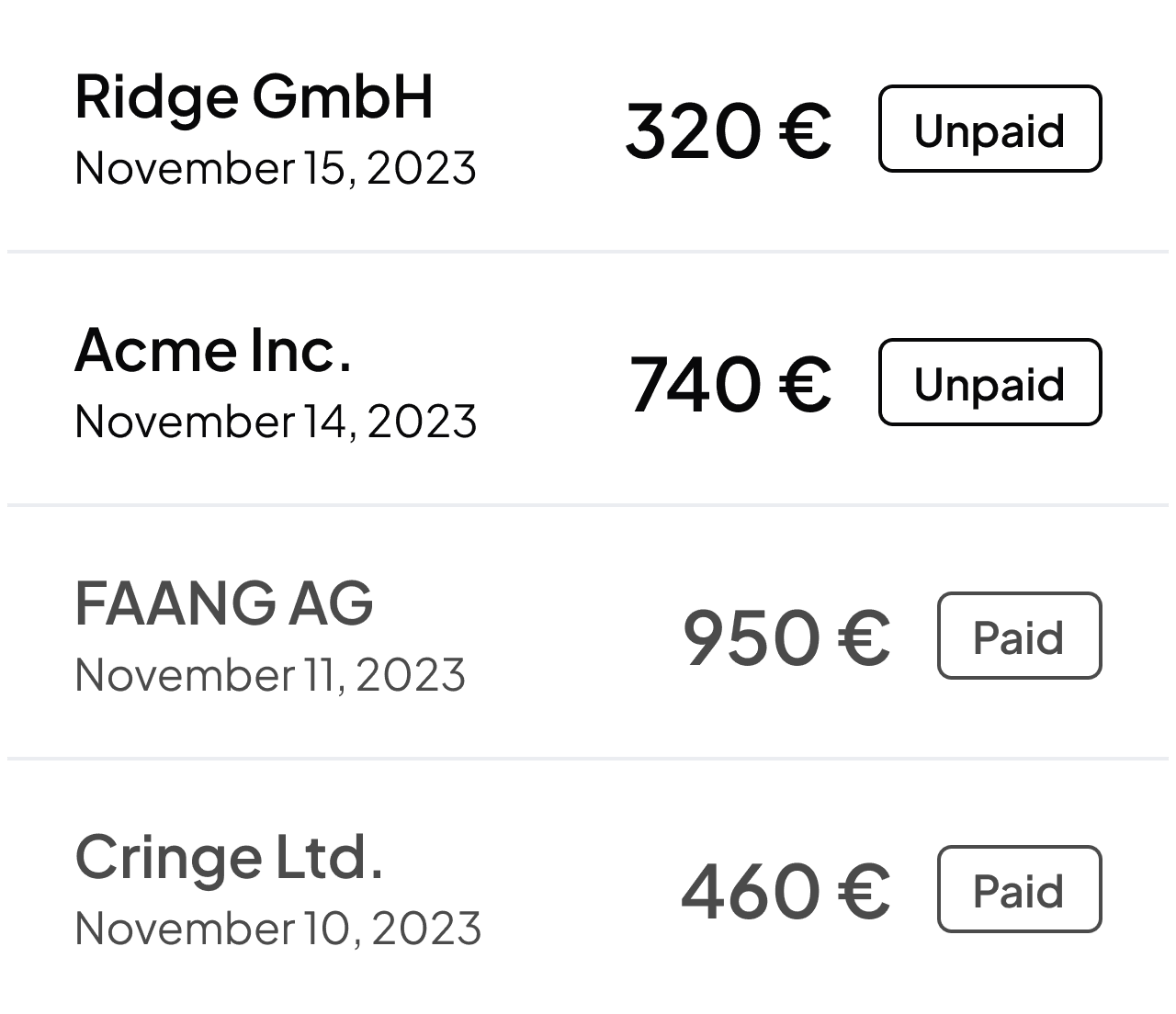

Easy e-invoices

Create compliant invoices and track payment statutes.

Easy e-invoices

Create compliant invoices and track payment statutes.

Easy e-invoices

Create compliant invoices and track payment statutes.

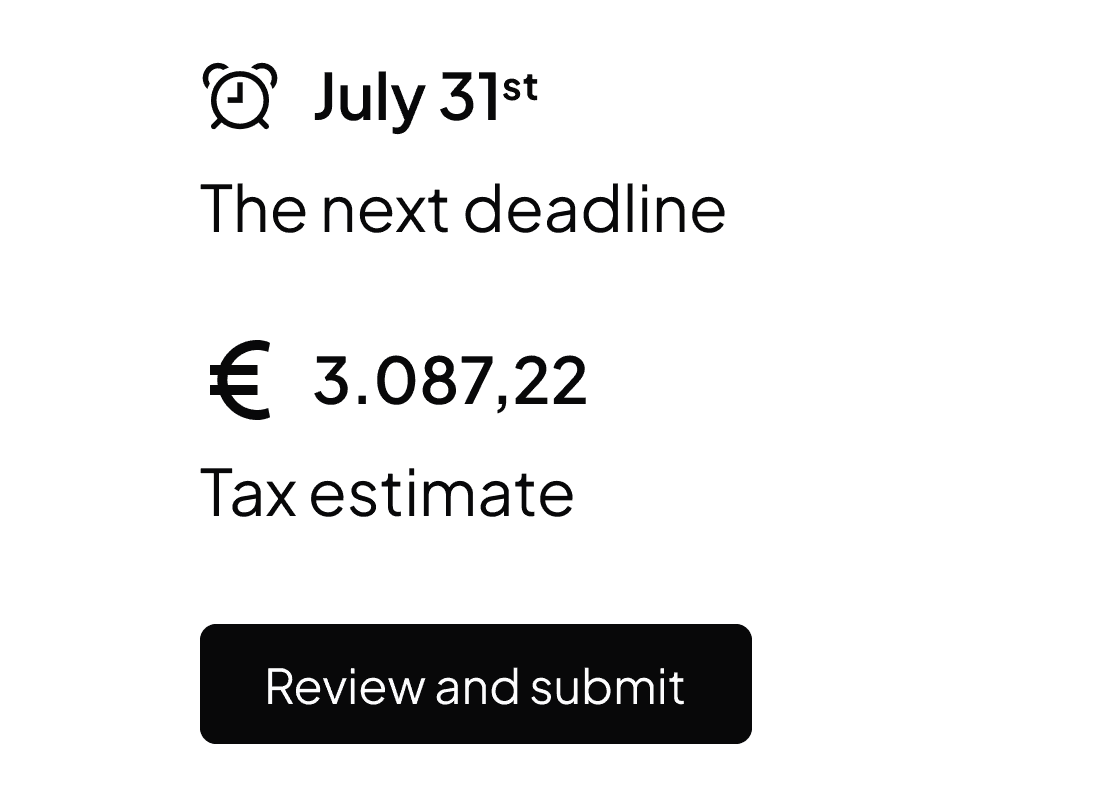

Live tax estimates

Know the next deadline and see your tax burden change in real-time.

Live tax estimates

Know the next deadline and see your tax burden change in real-time.

Live tax estimates

Know the next deadline and see your tax burden change in real-time.

Bank sync

Bank sync

AI advisor

AI advisor

Voice invoicing

Voice invoicing

Start for free

Start for free

Wow support

Wow support

Pay less for accounting.

Pay less for accounting.

Pay less for accounting.

Save time with AI Autopilot. Stop wasting hours on taxes, invoices, and gathering receipts.

Save time with AI Autopilot. Stop wasting hours on taxes, invoices, and gathering receipts.

Save time with AI Autopilot. Stop wasting hours on taxes, invoices, and gathering receipts.

3 150 €

3 150 €

3 150 €

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

Send tax returns directly to the Finanzamt, no tax advisor needed.

8 hours

8 hours

8 hours

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Norman detects VAT, auto-match expenses, and accelerates invoicing.

Stress

Stress

Stress

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

Never miss a deadline again and get individual tax tips to maximize profits

At Norman, the essentials are free.

Also, it's tax-deductible.

Billed yearly

(3 months free)

Free

Core accounting for free.

€0

Self-employment registration

Unlimited e-invoicing

Tax write-off tips

Expense management

Bank sync

AI Autopilot

Get started

Klein

For Kleinunternehmer.

€11

/month (excl. VAT)

- 25%

Annual tax declarations (EÜR)

Personal income tax

Declare salary as an employee

EU revenue reports (ZM)

Invoicing pro plan

Human support

Get started

Pro

For self-employed charging VAT.

€22

/month (excl. VAT)

- 25%

VAT returns

All tax declarations

Tax efficiency score

Receipt auto-matching

Invoicing pro plan

Human support

Get started

Billed yearly

(3 months free)

Free

Core accounting for free.

€0

Self-employment registration

Unlimited e-invoicing

Tax write-off tips

Expense management

Bank sync

AI Autopilot

Get started

Klein

For Kleinunternehmer.

€11

/month (excl. VAT)

- 25%

Annual tax declarations (EÜR)

Personal income tax

Declare salary as an employee

EU revenue reports (ZM)

Invoicing pro plan

Human support

Get started

Pro

For self-employed charging VAT.

€22

/month (excl. VAT)

- 25%

VAT returns

All tax declarations

Tax efficiency score

Receipt auto-matching

Invoicing pro plan

Human support

Get started

Billed yearly

(3 months free)

Free

Core accounting for free.

€0

Self-employment registration

Unlimited e-invoicing

Tax write-off tips

Expense management

Bank sync

AI Autopilot

Get started

Klein

For Kleinunternehmer.

€11

/month (excl. VAT)

- 25%

Annual tax declarations (EÜR)

Personal income tax

Declare salary as an employee

EU revenue reports (ZM)

Invoicing pro plan

Human support

Get started

Pro

For self-employed charging VAT.

€22

/month (excl. VAT)

- 25%

VAT returns

All tax declarations

Tax efficiency score

Receipt auto-matching

Invoicing pro plan

Human support

Get started

Learn more about taxes and finance in our blog.

Get tax tips right in your inbox

By subscribing, you agree to our Terms & Conditions and Privacy Policy

FAQ

What exactly is Norman?

Can I really do it myself?

How much does Norman cost?

Does Norman support freelancers and Gewerbetreibende:r?

Can I trust my data with Norman?

Does AI make a difference?

I am not self-employed. Can I file my income tax through Norman?

What exactly is Norman?

Can I really do it myself?

How much does Norman cost?

Does Norman support freelancers and Gewerbetreibende:r?

Can I trust my data with Norman?

Does AI make a difference?

I am not self-employed. Can I file my income tax through Norman?

What exactly is Norman?

Can I really do it myself?

How much does Norman cost?

Does Norman support freelancers and Gewerbetreibende:r?

Can I trust my data with Norman?

Does AI make a difference?

I am not self-employed. Can I file my income tax through Norman?

© 2025 Norman AI GmbH

© 2025 Norman AI GmbH

© 2025 Norman AI GmbH